In the world of online commerce, not all transactions are created equal. Businesses operating in industries like online gambling, adult entertainment, and other high-risk sectors face unique challenges when it comes to processing payments. These industries often encounter higher rates of chargebacks, fraud, and regulatory scrutiny, which makes finding a reliable payment processor crucial. However, not all processors are equipped to handle the complexities of high-risk transactions, leading to a range of issues from delayed payments to frozen accounts.

The stakes are especially high in the casino payment sector, where swift and secure transactions are essential for maintaining customer trust and ensuring the smooth operation of the business. Yet, many high-risk payment processors fail to meet these demands, leaving businesses frustrated and financially vulnerable. This article aims to shed light on some of the worst offenders in the high-risk payment processing industry, focusing on those that have consistently garnered negative feedback.

Whether it’s hidden fees, poor customer service, or unreliable transaction approvals, the processors reviewed here have fallen short in one way or another, making them poor choices for any business operating in a payment high-risk environment.

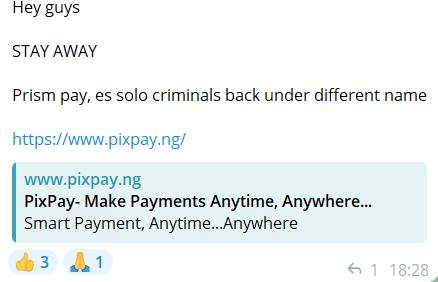

Oculus or PrismPay: A High-Risk Gamble

More known as – Es Solo Holdings Ltd. Oculus and Prismpay are part of a scheme, have stolen millions from merchants. They have been run by Gilbert “Gil” Armenta, who has been charged in the U.S. for money laundering in the OneCoin scheme.

They has quickly gained a notorious reputation in the payment high risk industry. Known for its unreliable customer support and frequent delays in fund transfers, Oculus has left many businesses in the casino high risk payment niche in a difficult position. Numerous clients have reported issues such as unexplained account freezes and hidden fees, which aren’t disclosed upfront. These problems make Oculus one of the least favorable options for high-risk payment processing. At the moment they are known as MOT Group – International Payment Gateway and PixPay

Greener Payments: The Illusion of Sustainability

Despite its name suggesting a reliable and eco-friendly service, Greener Payments has proven to be anything but dependable in the high-risk payment processing world. Clients in the casino payment sector have expressed frustration over inconsistent transaction approvals and a lack of transparency in their fee structure. The service’s sustainability promises fall flat when faced with its frequent technical issues and subpar customer service, making it a risky choice for businesses.

Here, we have written an review about this ”fake” gambling payment solution.

RagaPay: High Risk, Low Reliability

RagaPay often appears in high risk pay reviews, and not for good reasons. Despite initial promises of seamless integration and quick processing times, many clients, particularly those in the payment casino high risk sector, have faced challenges with delayed payouts and inconsistent approvals. The lack of transparency in fees and frequent customer service complaints have further solidified RagaPay’s position as one of the worst processors in the industry.

LivitPay: A Risky Proposition for Casinos

For businesses in the casino payment industry, LivitPay has been a source of ongoing frustration. Known for its frequent technical glitches and prolonged customer support response times, this processor has left many clients feeling unsupported. The high risk payment processing environment demands reliability, but LivitPay has repeatedly fallen short, making it a risky choice for anyone in the industry.

KianoPay: A High-Risk Headache

KianoPay has become synonymous with headaches in the casino high-risk payment sector. They became successful in early 2024 with the release of Open Banking solution for UK (Faster Payment) and EU markets. Which showed good approval ratio, FTD allowed and local currencies supported with a settlement via crypto and they and they boarding operators both without a license and with offshore licenses

They worked stably for about 2 months and then, having come up with fake messages about supposedly frozen bank accounts, they disappeared with all the money of their merchants.

Conclusion

The high-risk payment processing landscape is fraught with challenges, and choosing the wrong provider can lead to significant operational disruptions. The processors highlighted in this article — Oculus, Greener Payments, RagaPay, LivitPay, and KianoPay — have consistently underperformed, especially in the casino high-risk payment sector, making them some of the worst choices available. Businesses are advised to conduct thorough research and read high-risk pay reviews before committing to any processor.

Read more: Best Gambling Payment Providers