The fintech company Trustly was founded in 2008 in Sweden. On this platform, users can pay directly from their bank accounts, such as online purchases. No card or virtual wallet is required. Thanks to the dynamic growth of the e-commerce industry since 2020, the service has also developed rapidly. Read more about Trustly’s features below.

What is Trustly

Trustly is an online payment intermediary that performs online transfers from a buyer’s bank account to a seller’s account. Today, the service supports over 12,000 European, Australian, and North American banks and 9,000 merchants. It has a consumer reach of 650+ million. You may ask for the list of Trustly supported banks from the support chat on their website.

It may seem similar to such payment processor as PayPal, but they still have differences. For example, no registration is needed to use the platform. However, users can register with the system to ensure their transactions are more secure. Trustly also pledges not to store information that can be used to access a user’s bank account. That said, it promises merchants will eliminate unnecessary KYC forms thanks to data from the customer’s bank.

What industries does it cater to

The platform offers products for areas such as:

1. E-commerce. Customers can order directly on the merchant’s website or app. A schedule can be set up to transfer payments and make them in installments. The service also takes responsibility for refunds, makes it easy to accept recurring transactions from customers, including subscription payments, and supports one-click payments.

2. Financial services include insurance, instant loans, trading, bank transfers, and account-to-account transfers in markets served by Trustly.

3. iGaming. Unlike PayPal Trustly users can transfer trustly gambling sites deposits from account to account without using cards or apps. Thanks to access to bank account deposits, they can also withdraw winnings quickly and play in land-based venues. Meanwhile, the Pay’n’Play feature, launched in 2016 for the gambling sector, is already supported by more than 150 brands.

4. Travelling. With Trustly’s online payments, travelers can transfer money without spending limits for large transactions and receive fast refunds.

Safety of the service

The system holds a European Payment Service Provider (PSP) license under the relevant directive (PSD, 2007/64/EC), which has been integrated into Swedish law through the Payment Services Act (2010:751).

Trustlyn is supervised by the Swedish Financial and Budgetary Supervisory Authority and complies with payment processing regulations. Therefore, payments within the platform require authentication. A transaction can only be carried out if the user has provided their banking credentials, including a one-time confirmation code known only to them. These credentials, as the service assures, are not stored on it.

https://www.youtube.com/watch?v=ZXFYT-BG2So[ZS1]

Of course, the platform guarantees that the whole process is 100 percent secure thanks to an encrypted connection to the customer’s online banking. However, it is worth remembering that banking regulations clearly state that you should not share your bank password with anyone. In the case of Trustly account or even bank account hacking, the service can absolve itself of responsibility for the lost funds because the client has exposed themself to such a risk.

How to make a safe transfer via Trustly

To avoid risks, responsible users can take certain precautions:

- Change the bank account password to a temporary one.

- Make a payment to the service provider using the temporary password.

- Change the temporary bank account password to a new one.

Another solution is to use a separate bank account dedicated only to payments through Trustly.

Transfer with Trustly

Trustly provides a convenient way to pay via online banking. But it’s only available for bank accounts in one of the 30+ markets the payment service serves. It’s also worth noting that Trustly banking doesn’t support payments from corporate accounts, so you’ll need to use another payment method, such as a card or bank transfer.

How Trustly payments work

1. Select the Trustly payments option on the recipient’s payment page.

2. Select the language and country.

3. Enter the login data for Internet Bank and select the bank where you have an account. If the required bank is not on the list, the user cannot use this payment option.

4. The login information goes to the Trustly platform connected to the bank.

5. Trustly verifies the user’s identity and transfers money to itself on their behalf.

6. The platform sends the payment recipient information about debiting the sender’s account.

7. The payee accepts the transaction and provides the product/service.

8. Trustly waits for the transfer from the user. A fee – about 2% from the merchant pay – may also be charged for the ability to make an immediate transaction.

Duration of payment processing

Payment processing through the site takes a few minutes to two working days, depending on the bank from which the transfer is made. It happens because some financial institutions may restrict the amounts sent using Trustly.

Maximum transaction amount

The service itself has no transaction limits. However, banks may have limits per transfer and payment recipient.

Product Reviews

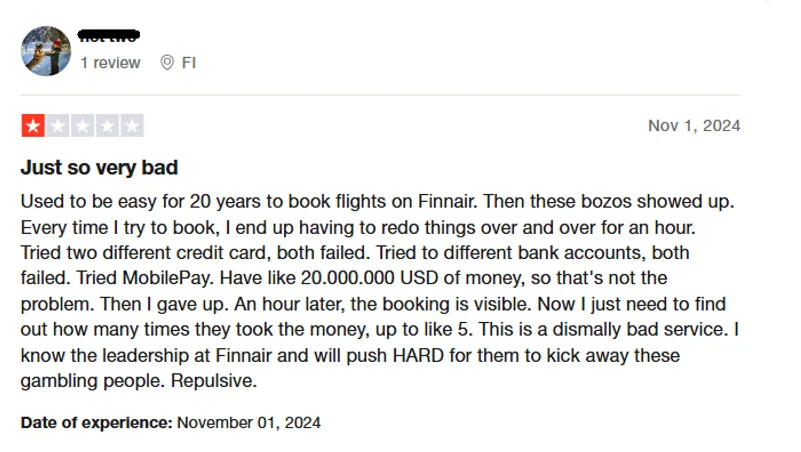

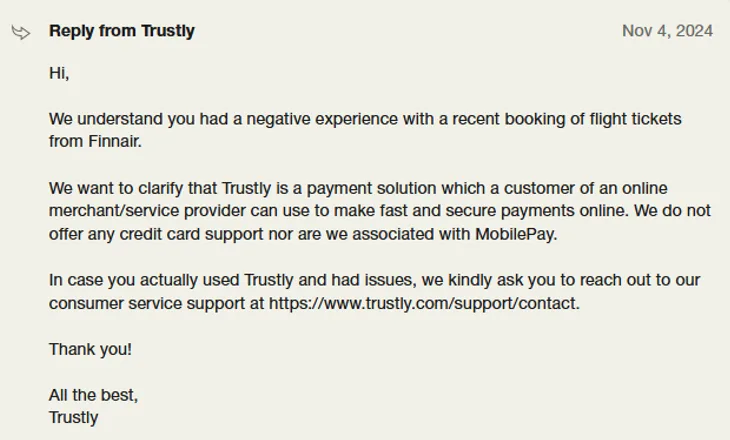

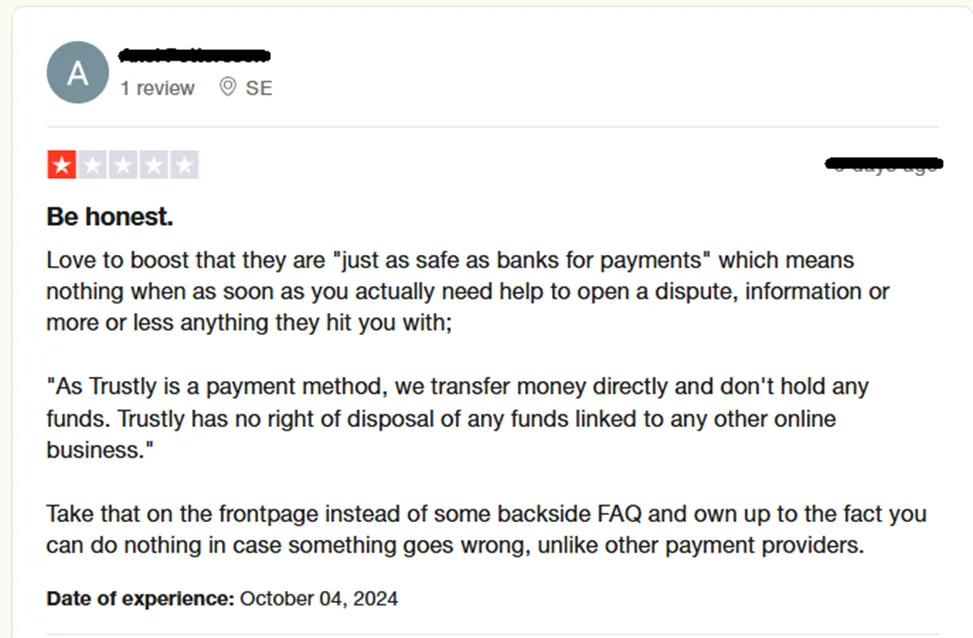

In reviews about Trustly online banking among users, you can find many complaints about payment troubles or delays.

It is worth noting that the service’s support team monitors sites with reviews and leaves comments:

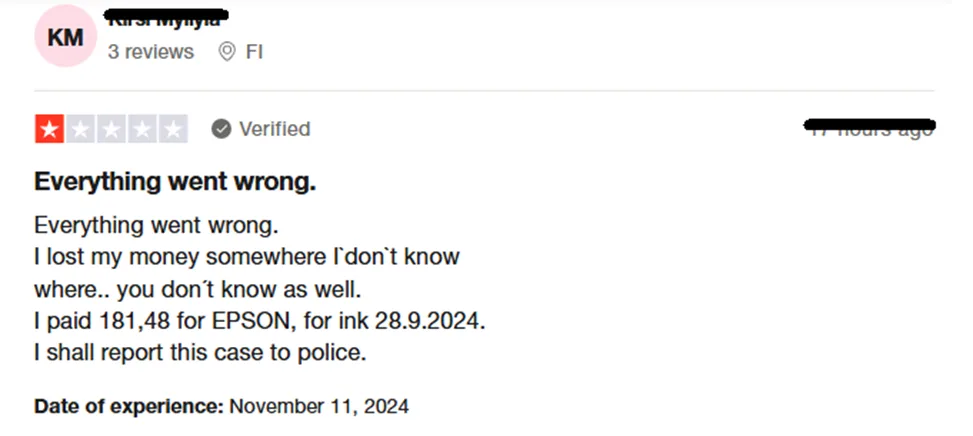

Dissatisfaction was expressed by this user, who has some unresolved issues:

This user`s comment attracts attention. Whether he is right or wrong is unknown, but it is worth being wary of such possibilities.

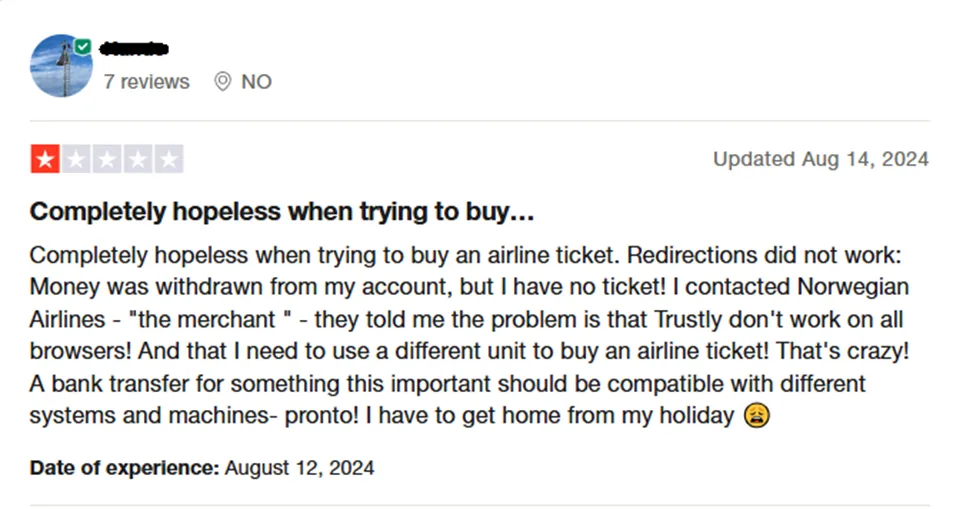

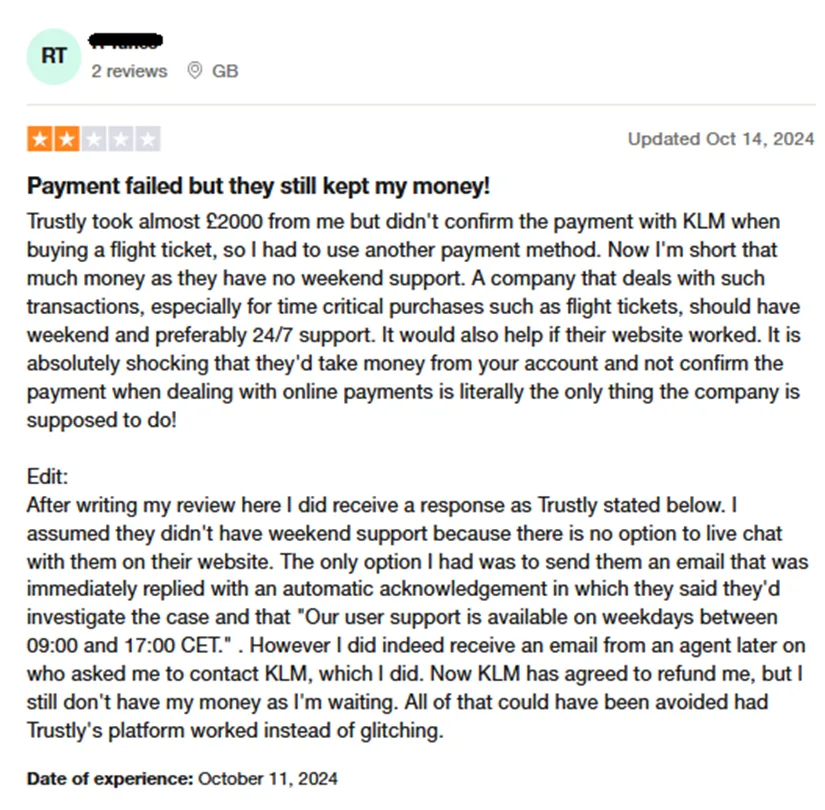

Also, a common problem among the site’s customers is payments that have not arrived, and this issue often occurs with flight booking:

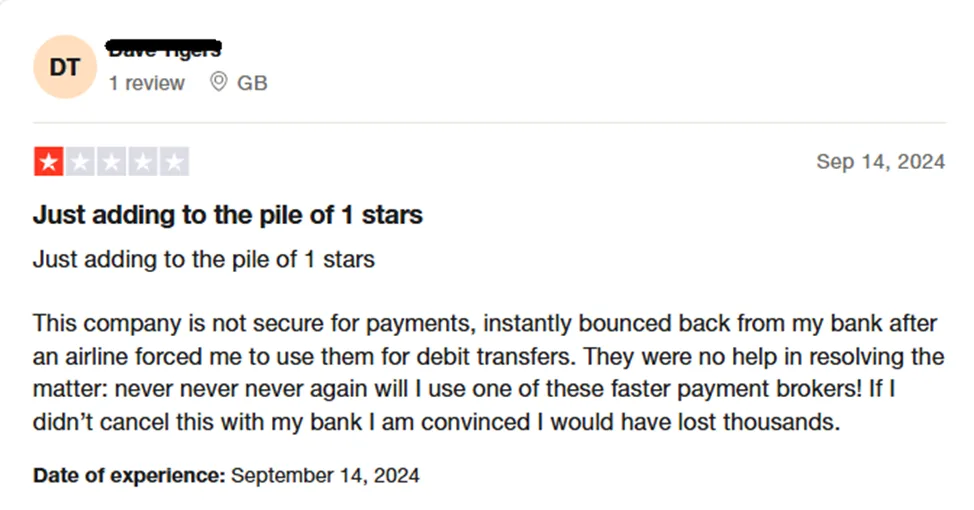

Users also complained about the service`s security:

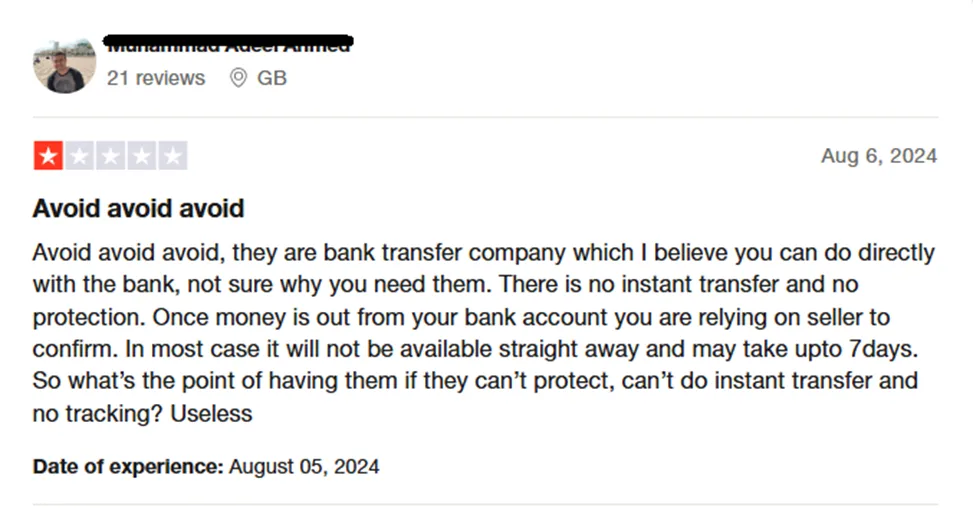

This user states that the service is useless:

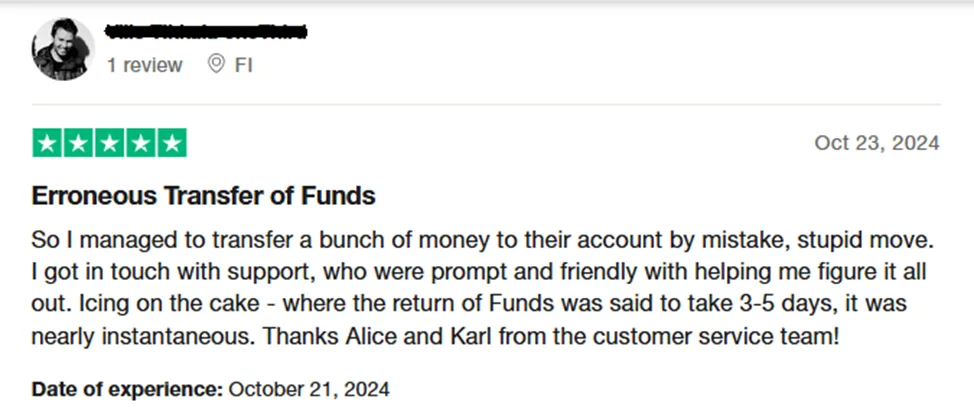

There are far fewer positive comments, but here they are:

Another user reports solving his problem with the service but not till the final result:

Conclusion

Transfers through the Trustly platform are licensed and protected by security procedures per European legislation. However, this does not guarantee the absence of problems for users. Funds hanging in an unknown space, delays, errors, extended e-mail responses from the support team, and making customers nervous do not contribute to their loyalty. However, delays are not fraud; users should be patient and wait. And the company, in turn, should improve its service.

Read More: Open banking casino