Money in any area requires strict regulation, and gambling is no exception. Annually, regulatory establishments worldwide launch more and more various ways to fight such an illegal process as money laundering. GBC Time has collected the most interesting facts about the illegal side of gambling and highlighted the most popular cases in global gambling history.

What is money laundering?

Simply put, money laundering is the process of hiding the real source of income to avoid tax service intervention. The reason why people come to such a crime is illegal or unregulated businesses like drug trafficking, corruption, gambling, etc.

How money laundering works

In general, the money laundering process consists of three stages.

Placement

The first stage includes the process of injecting illegally earned money into the legitimate financial system. For instance, money that came from drug trafficking is registered as income from the fake hotel business.

Therefore, the tax office does not even suspect that this money is earned in another way.

Layering

The next step is to conceal the source of money by launching several transactions and bookkeeping tricks. This stage is more about the documentation and “official” confirmation of the fact that the money was allegedly earned legally.

Integration

The last stage of the integration includes the withdrawal from the legitimate account to be used for whatever purpose the criminal has in mind for it.

Money laundering in gambling

Gambling is one of the most common industries for money laundering crimes because of the huge money flow both offline and online. Moreover, in countries where the casino business is not regulated by the government, money laundering becomes even more accessible for criminals. Let us get deeper into this side of the gambling industry and identify how it is even possible these days.

Annually, the global gambling industry income increases at an incredible rate. According to Research And Markets report, just in 2022, the global market reached $747.9 billion in income. Moreover, the experts predict even further growth, which is expected to reach $876 billion by 2026.

The offline gambling business is probably one of the biggest markets that include cash. Slot machines, poker rooms, offline betting shops, and regular casino hotels gather millions of visitors all over the world. It is not even a surprise that money laundering cases are extremely common in this niche. It is also evident how often money laundering can be seen in the casino business. But their scale is sometimes shocking.

A relatively recent scandal happened with the Crown casino located in Australia – the regulatory establishment accused the land-based operator of money laundry of thousands of millions of dollars through the business in a period from 2014 to 2019. And there have been even larger-scale cases in history.

Most common tactics of money laundering in gambling

Cash-in & Cash-out

The money laundering process in gambling may be a little different from the same process in any other sector. Most of the time, they are simple and fast such as converting dirty money into chips or an electronic balance. Another common way of money laundering in the casino business is dividing the money into several smaller betting accounts.

The Vancouver Model

This model was the main tactic in money laundering through British Colombian casinos from 2008 to 2018. The scheme implies the moving in and out of large sums of money to different jurisdictions by replacing dirty money with money earned in another way. As the result, all the money is exchanged with the casino chips that a fake player bets during the game and get a fake winning in the casino.

Collusion between players

This method of money laundering implies the deliberate loss of one player. This model is suitable for both offline and online casinos. A player deliberately loses, for example, in a poker game, so that another fake player can win the same money. The most important advantage for fraudsters in this model is that it allows fraudsters to evade any AML detection policies.

Mixing gambling and non-gambling laundering methods

This method allows criminals to hide money obtained through illegal gambling operations through another business, such as real estate or cryptocurrency. This allows them to have an additional layer of protection from the authorities and the police.

Cryptocurrencies in the gambling industry: problem or solution?

If cryptocurrencies are used to launder money, then they are a problem. However, if cryptocurrencies are used to implement KYC/AML procedures and to conduct blockchain analysis, then they can be used to help prevent money laundering. Cryptocurrencies should be perceived only as a payment instrument, which has become very popular in gambling in recent years. Popular crypto payment gateways do such as PassimPay offer many benefits to both operators and players: privacy, instant payment processing, low fees, 24/7 support and the ability to gamble and make payments around the clock from anywhere in the world.

The biggest money laundering scandals in the gambling industry

Vancouver casinos were caught in money laundry crime

British Columbia is one of those Canadian states, where the casino sector is legalized and fully regulated. However, the criminals are still able to find the detour in the financial transactions in this business.

In 2019, the Bureau of International Narcotics and Law Enforcement Affairs researched the money laundry crime history worldwide. As an outcome, Canada was identified as one of the most popular markets for money laundering cases because of the plenty of gaps in the law system. Moreover, the most gambling-friendly region of the country has been British Columbia, which makes a significant financial contribution to the national budget. In 2015-2016, the gambling industry in Canada earned 3.1 million Canadian dollars in revenue. One-third of this sum became financial support to hospitals and the healthcare industry. Back to the money laundering case.

According to the local gambling regulator report, the object of the case was a middle-class family, which transferred at least 114 million Canadian dollars to British Columbia. The dirty money was hidden in cash inside the garbage bags and hockey bags.

This and other money laundering crimes became a part of the huge scheme, which pulled the country’s economy to the bottom. In 2018, up to 5.3 billion Canadian dollars of dirty money was earned through the estate investment that eventually increase the housing price in the market by 7.5%.

Canada is the perfect example of how gambling money laundering crime can affect the whole country’s financial situation and its pricing.

One of the biggest San Diego money laundering crimes

In 2015, US regulation caught twenty-five people in financial crimes through the gambling industry. In total, there was $10 million of dirty money laundered through the Chula Vista and San Diego casinos. This crime is considered to be one of the biggest illegal gambling prosecutions in San Diego County.

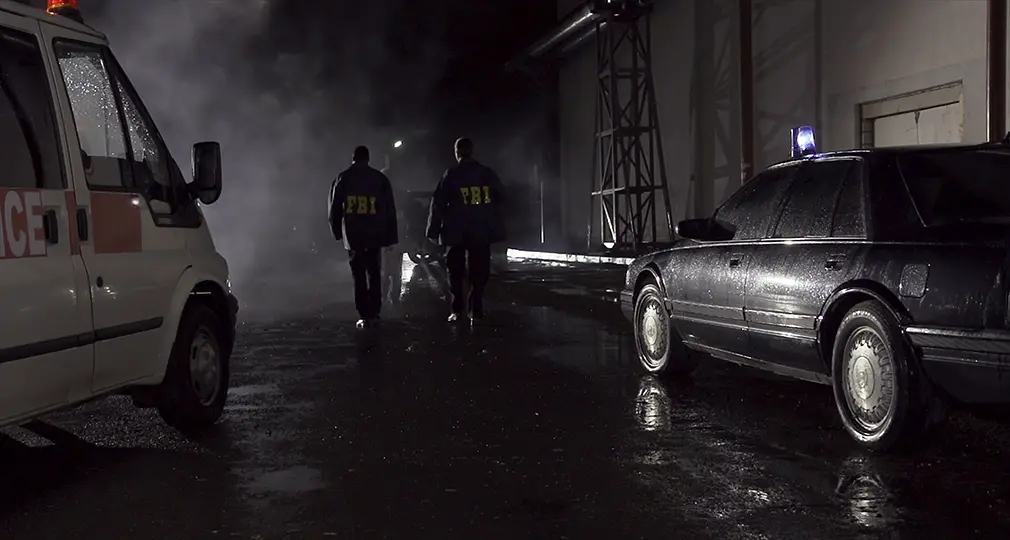

More than 200 FBI officers along with agents from other institutions arrested 21 suspects around the country.

In the seizure places such as the Village Club Card Room and the Palomar Card Room in San Diego, the authorities confiscated over $600 000.

Poker player arrested in connection to money laundering

2022 definitely became quite shocking for the poker industry because of the huge money laundry case that happened in New York, US. In the outcome, a popular professional poker player Cory Zeidman was arrested in charge of the money laundering of $25 million.

Zeidman gained popularity in the poker industry when he won a World Series poker bracelet. However, the peak of his famous personality was definitely after the allegations. Supposedly, he operated the whole scheme between 2004 and 2020. The crime organization named Phoenix was a serious financial crime in the world of gambling.