There are hundreds of online casinos opening every day in Europe. Unfortunately, not all of them manage to succeed and become profitable. Tight regulations and the shocking number of bonus fraudsters force countless numbers of casino companies to leave even the most prestigious markets like the UK. Unlike most of the cases on GBC Time, this is a story of a failure, which could be eye-opening for some iGaming ops.

Alexandre Tomic, founder and CEO of casino game aggregator Alea, shared his experience of opening and closing an online casino in the UK market. Alexandre also told GBC Time about the problem of bonus abuser networks that are actively attacking casino operators in Europe and the US. The text below is in Alexandre’s own words.

Case: how the company lost €1.5 million in 2 months in the UK market

In 2018, Alea entered the UK market with two brands – Slots Million and Lady Lucks.

We developed our own platform with our own resources

In the beginning, when we launched in the UK market, the platform was ours, everything was ours. A lot of companies do not have a platform, they rent or buy it. But we developed the platform. So, we had development resources, we had 30-40 developers.

80-90% of development resources went into AML and responsible gaming

And at some point, all the resources – 80-90% – of our resources went into anti-money laundering tools and responsible gaming tools. Everything we were developing, all the features we were doing for the platform – like slots tournaments, gamification – everything stopped. And every development resource went into responsible gaming and AML. It happened right when we entered the UK market.

The Head of Product became the Head of Compliance

And the thing is that this was so important that in the end, our Head of Product became the Head of Compliance. We needed to be compliant by design. Not just having the responsible gaming team, the payment team, or the fraud team, it needed to be a code designed within the platform itself. Otherwise, it would not work. To make you understand how much it impacts the mindset of the company, later, we hired a Head of Compliance from one of the biggest regulators in Europe.

The brands instantly attracted many players

When we just came to the UK iGaming market, we instantly acquired a lot of players. And many players = a lot of deposits.

October 2018 – high acquisition and high GGR

In the first month, October 2018, we had a very high level of GGR on both brands. Everything was shining. In the first month, just in the UK market, we were reaching – €0.5 million GGR, which is a lot when you start in a new market. And we had 2 to 3 thousand players.

The second month – acquisition grows while the GGR drops

What happened next, is that in the second month, the acquisition continues growing but the GGR goes down. And we cannot understand why.

The third month – alarmingly high GGR losses

So, in the third month, it becomes a slaughterhouse. Basically, we are losing money at a very alarming level and we do not understand why because we continue acquiring players.

By February the company lost around €1.5 million

We started losing money in December, January, and February. By February 2019, we lost about €1.5 million. And we were clueless about what has happened.

Bonus abuse was the key problem

Now, what we see is that we give a lot of bonuses. We had a lot of “bonus turn to real” offers: basically, the player deposits real money and gets a 100% bonus up to £100. And this £100 bonus money goes through wagering requirements 35x-40x real money + bonus money. So, if someone deposits £100, they have to wager £7 000 in order to be able to withdraw.

We noticed that at these two casinos, we had a lot of this bonus money that was turned into real funds.

80% of the bonus money went to a very little number of players

But the thing that we could not understand is that 80% of that bonus money was going to a very small number of players. So, there are very few players that are turning this bonus into real money.

And I see that today, operators are still having exactly the same problem: in the UK, in Sweden. Now, the UK operators are more aware of that, but the US ops that having even bigger problems with it.

The mechanics of the bonus abuse

Let me put on the table the mechanics of how this works.

Player deposits £100

What you see is that players are coming to a casino and depositing £100. They have got £100 bonus money but they first have to spend real money in order to be able to spend the bonus money afterward.

They play these £100 on the roulette

So, they play £100 real money on the roulette on one number. So, basically on the roulette, you have 36 numbers:

- 18 red;

- 18 black;

- The zero – green.

And these guys were playing one number each. Statistically, you would have 36 players that lose and one that wins. So, what do we see – we see 36 losers who lost £100 and 1 guy that wins £3 600. Is that bad? No, I mean, we are ok with that. It is the normal statistic of a roulette.

There are bonus abuse networks behind the schemes

What we do not see at that moment, however, is that it is all exactly the same person. And actually, it is a company. There are businesses in the UK that are recruiting players for their identity. Basically, it is a sub-niche industry of iGaming. There are ads on LinkedIn recruiting for these companies.

So, if I get back to my example, we have 1 player winning £3 600 and we have 36 players that lost £100. The guy that wins, wins with the real money, he does not play the bonus. Now, that is where the scam starts.

If you imagine that it is one player, and one player would deposit £3 600 or £3 700, he would get £100 bonus money. But if you deposit £100, you get £100 as well. If you deposit £200, you still get £100. Because it the offer limited to £100.

98% of their funds are bonus money

So, if you do not look at the retention offers, and let’s do it for the sake of demonstration, someone that comes and deposits £3 700 is going to get £100. These guys deposit £3 700, and they get £3 600 because the one guy that won does not have the bonus money. So, they have something like 98% bonus money on a very big amount of money (£3 600 out of £3 700).

Scammers open accumulative bonus games and stack up the progressive feature

So, what is going to happen? They take the £100 they have, players have to start playing games. With bonus money, they play the games called an accumulative bonus.

Every iGaming provider has these slots in their gaming library.

You play and you have a kind of feature – a meter that goes up. And when the feature goes up, the scammers stop and close the slot. (Do not forget, they are playing with bonus money. If they would have won, you would have won bonus money.) And they open another slot like that. Let’s say, they play £20-£25 of the bonus money. And with £100 they are going to be able to do it between 3 and 4 slots, where they are going to go very close to the top of the bonus meter and close the slot. Now, they have a zero balance bonus.

They deposit real money and reopen the slot, generating real high wins with just a £20 bet

They go, they deposit £20, they reopen the slot, and the slot keeps the progression bar as it was before.

It is a part of the game; it is a retention tool for the software provider. But the software provider does not care if it is bonus money or real money. So, they are going to invoice the operators the same way.

Now, what is going to happen – the players are going to place real bets and it is going to generate a real win. But with a feature that has been stacked up with bonus money. And as these slots have a distribution or the RTP, everything goes into the feature, and there is a very few RTP that is redistributed in the main game.

They are playing the real game with the bonus money and they are generating real wins with bonus money through the feature game. So, what happens – then, they have real wins coming from real bets.

Before 2015-2016 scammers would play on high-volatility slots

Before these slots appeared in the market, in 2015-2016 the scheme would go like that:

- Scammers would go on very high volatility slots. They would play the game, most of them will lose, and the operator would say: “Ok, I’m happy, it is all losers”;

- One of them, however, will win £20k-30k, and then they would go on very high volatility. It did not matter that game had low RTP because what they wanted to generate was a very high win;

- Then, they would go on a very high RTP – low volatility game in order to go through the wagering requirements and extract the money.

But today, they do not even have to do that because of the accumulative bonus feature slots.

A loophole in the bonus engines allows fraudsters to scam casino ops

If you see the mechanics, it is a terrible loophole in bonus engines of operators.

Until today, I don’t know about any software provider that has addressed the issue. So, the burden stands on the operator. You also have companies that are analyzing this data to help operators identify these networks of bonus abusers.

In the US, bonus scammers can earn up to $18k per player identity

That is exactly what is happening in the US, and then you cross borders from one state to another, and they repeat the same thing again and again in different states. The guys from Greco analyzed that the value these abusers can get in the US out of bonuses is around $18 000 per player identity, which is just crazy.

It is very easy today for a player to access the information about these bonus abuse schemes and repeat it from one casino to another casino. Now, US operators are being completely washed out by the players that have the knowledge, and that have the resources to cross the border. And I believe it is going to get worse when the UK bonus abuse companies and networks will organize themselves in the US. For the moment in the US, it started because the market is just launched. You have people doing bonus abuse but they do not have the level of organization or expertise that you can see in the UK. So, when these guys are going to organize themselves better, they really going to take advantage of this market.

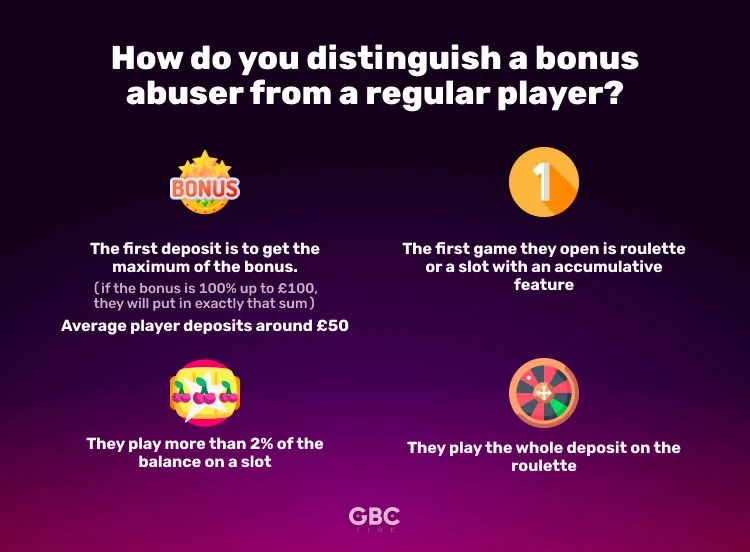

Signs of dealing with bonus abusers: expert’s insight

It is actually very simple to discover these fraudsters. The moment you see it, it all becomes so clear. I spend myself 4 days analyzing almost 1k players and I understood something very simple and, to be honest, it is very easy to stop.

All these players deposit exactly £100

The pattern is the following: all these players take advantage of the maximum bonus. The bonus is 100% up to £100. So, they will deposit exactly £100. They will not deposit £80 because they lose the £20 bonus. They will not deposit £120 because then they put £20 real money, which will not be a bonus. So, they all deposit £100.

You could say that some real players do that too. True, but if you start looking at your stats, you see that it is not. Most of the real players, when they come and they do not know a casino, they deposit basically £50. That is the average number we see.

They bet the whole deposit on the roulette

And now, imagine that we say we have 95% of the players that deposit £100 – the bonus abusers and 5% that are not. How do we look at that? Well, it is simple. If the first thing they do is they open a roulette and they make a bet of £100, you have a bonus abuser.

They wager more than £2 on slots

You could even do it more easily. If they deposit £100 and they play more than 2% of the balance (which is £2) even on a slot, you have probably a bonus abuser. A normal player would play £0.2, £0.5, and a maximum of £1. If they play £2, or £5, or £10, you have a bonus abuser. Because basically what are they trying to do is to generate the highest win at the beginning.

They play roulette or accumulative slots first

And if you want to be 100% sure, you will look at which type of games they play. If the first game they play, is roulette or a slot that has an accumulative feature, it is probably a bonus abuser.

What the company did to combat bonus abuse

Once we have seen that, basically we started:

- Very closely monitoring players that were depositing £100

- Doing very high KYC on them.

The scammers typically pass the KYC

The problem, to be honest, is that these players pass KYC. They do pass it because they are real people that sold their identities to these networks.

If the client passed the KYC, we must pay

So, we pay. It is the only thing you can do because you have the UK Gambling Commission (UKGC) above.

The only thing to do to counterattack is to design offers that do not leave you vulnerable to these kinds of tactics. Obviously, it depends on your bonus engine. And you do not want to penalize real players. You can say: “You cannot play this game”, but players love this game. It is very hard to fight and you really need very quickly to disallow some kind of bonus.

A sticky bonus is a way to counterattack but it is banned in the UK

And in the UK, you cannot do sticky bonuses. A sticky bonus is when you put £100, you have a £100 bonus and it becomes £200 bonus money. You cannot withdraw the real money anymore, it is sticky. Here, you do not have the problem of spending the first real and then bonus money because it is all the same kind of money. And the wagering requirements apply to both funds together. So, there is nothing to be done.

But the thing is that in the UK, the GC considers that you cannot hold onto the player’s real funds in any way

You have to restructure your bonus system and focus on player retention instead

So, the only way to go is to have a welcome offer that is probably not going to be as attractive, but where you are going to reward the players that are staying longer more. Basically, you are going to reward loyalty with retention.

What you also need to do is, instead of giving all your marketing and bonusing budget at the first deposit or the welcome offer, you need to be able to keep attractive welcome offers that are non-abusable and put your marketing budget in retention – in little reward players get for coming back. And even then, you need to do it in a smart enough way that it does not appeal to abusers. Because if they cannot make money from the first deposit, they are going to make money at the second, the third, the fourth, etc.

Marketing was a nightmare

Marketing was becoming really complicated because we were responsible for the way our affiliates were marketing us. So, if an affiliate would make a banner and change wording so it would incentivize players, we would get the warning from the UKGC. We had to check our affiliate website regularly. So, our affiliate managers started spending non-negligible part of their time going on affiliate websites and monitoring the way they were advertising us, and what they were saying about us. We used some tools like Rightlander to make our affiliates compliant.

The affiliate team spent 30% of their time checking compliance in the UK

I had 4 people in the affiliate team, and they started spending 30% of their time checking if we are compliant in the UK, which was one very small market.

You want to be in the UK, it is so prestigious. But at some point, you start thinking about whether it is worth the money. Imagine a middle-class guy that rides a Ferrari and how much does it cost to maintain a Ferrari. Or he has a yacht and he lives in a small apartment. You ask him: “Why do you have a yacht?”, and he says: “I want to impress my friends”. It is something like that with the UK license. And meanwhile, you have people making a bunch of money in the CIS in Asia.

€300k TV commercial did not work

We did a TV commercial, we spent something like €300k on that. We released it but we were just losing money on this.

The only thing that really paid off was affiliate marketing

We had about 50 affiliates. And, basically, you have less than 10 affiliates that generate 90% of the traffic. So, have the affiliates that generate your traffic in every single country. And then you have country-specific ones. In the database, we have hundreds of affiliates, 50 that are sending traffic, and 10 that generate the most traffic. What happens is that some affiliates generate a lot of traffic in year one. In year two, they disappear. Or they are buying each other.

The company left the UK market in 2020

We did all of this, but we left the market in 2020. We left the market after four warnings from the UKGC.

The casino brands never reached more than €1 million GGR

When we left the UK, the GGR was not big, believe me. I think we never managed to reach more than €1 million in the UK. Maybe, €1 million was the most we have ever reached in the UK. Some companies that considered us big in the UK (from the number of players), were doing €5 million, and they are losing money today.

Acquisition cost was 50-55% of GGR

We stayed between €500k and €1 million GGR, but what was crazy is that EBITDA would drop. Because the cost of acquisition was extremely expensive – it was around €200k – €300k monthly just for the UK market. Basically, the acquisition cost of the UK was 50%-55% of the GGR.

Investments

I think we have never done the calculation on the size of investments. I think, at some point, we just closed our eyes and we knew it was not profitable, we knew it was not sustainable.

We were lucky, we did not get fined, but after the fourth audit, my impression was that the fifth would be the one where we would get the fine. And that is when the split between B2B and B2C happened, and we shut down the UK operation.

The regulator does not protect iGaming ops against fraud networks

When you have the UKGC license, you have these companies, these networks (of bonus abusers) that are attacking you. The regulator is here to protect players but it should also protect licensed ops against illegal operators and companies that are doing illegal activities.

What these networks do is called aggregated accounts, and these are illegal. It is also called collusion. It is very hard to understand collusion from the online casino point of view because it is not like poker, where players have to play against each other. But once you insert the bonus money inside this ecosystem, you do have collision, when you have an aggregated balance. And UKGC would not bother with that. So, basically, they are defending players, which I find very legitimate and good, but would not defend ops against these types of players.

Most of the casino ops left in the UK are land-based

I think if you look at the UK online market today, there are very very few ops left that are not land-based that have been in the market for many years, like Ladbrokes, bet365, and William Hill. Who is left today in the UK with pure players and making money? I am not going to name anyone, all of the ops that were in the UK in 2016- 2020, everybody left. And if they still hold the license, the GGR they have in the UK is just funny. They still have a UKGC license in order to have more value to the company – because it is prestigious. And they are making money in pre-regulated emerging markets. But you cannot be profitable in the market like UK or Sweden today. And in the UK, the only ones that can benefit from online are land-based operators.

The UK experience made the company more structured and organized

It did structure the company. I mean, all these conversations we had with the UKGC were not bad. It did make us grow – think better, be better, become more organized. It is just that at the moment we felt we were not at the level for them. And we felt we were never going to be at the level. When we felt the game has reeked. It made us grow as a company. It also made us more aware of the problems players could have, like gambling addiction.

At the product level, the product stagnated. We were innovative but at the point, we entered the UK market, we stopped being innovative, we did not have the time anymore, and we did not have a focus to do it. We just focused on developing and reporting tools for the UKGC, reality checks, etc.

Read more: Best iGaming Aggregators