The world of stock market trading has seen a tremendous transition in today’s dynamic financial environment, mostly due to the emergence of Internet platforms. Over the past decade, traditional methods have given way to convenient and accessible online trading, revolutionizing how individuals participate in the stock market.

In this article, we will explore the rise of online trading, give you reviews on the best websites for stock trading, and tips for successful stock trading.

Introduction: The Rise of Online Stock Trading

The rise of online stock trading has revolutionized participation in the stock market, shifting from traditional methods to convenient online platforms. The widespread availability of high-speed internet connections, real-time data, efficient tools, and the development of user-friendly trading platforms have empowered people to directly access and trade in the stock market from the comfort of their own homes.

Online trading also offers lower costs, attracting a more comprehensive range of investors, including small retail investors. This trend aligns with self-directed investing, supported by educational resources and community forums. Mobile trading apps have further democratized participation, providing flexibility and convenience.

Overall, online trading has transformed the financial landscape by breaking barriers, reducing costs, and giving investors greater control, shaping the future of stock market participation.

Factors to Consider When Choosing a Stock Trading Website

- Reputation and Security: Selecting the best trading information websites with a strong reputation and a track record of reliability and security is crucial. Look for platforms that are well-established and regulated by reputable financial authorities. User reviews and ratings can also provide insights into the platform’s reliability and security measures.

- User-Friendly Interface: A user-friendly interface is essential for seamless navigation and efficient trading. Choose a platform that offers an intuitive and easy-to-use interface, enabling you to quickly access the information and tools you need to make informed trading decisions.

- Trading Tools and Research Resources: Evaluate the platform’s trading resources and research tools. Aspects to look for include real-time market data, charts, technical analysis tools, and resources for fundamental investigation. These instruments can be used to find investment opportunities and spot market trends.

- Order Execution and Speed: Make sure the trading platform delivers dependable order execution that is quick to minimize slippage. Seek trading platforms with solid infrastructure and cutting-edge technologies for efficient and fast trade executions.

- Cost and Fees: Consider the cost structure and fees associated with using the trading website. Compare factors such as commission rates, account maintenance fees, and additional charges for specific features or services. Select the best websites for stock trading information that aligns with your budget and offers competitive pricing.

- Range of Tradable Assets: Determine the scope of tradable assets available on the platform. Some websites specialize in specific markets or asset classes, while others offer a broader selection. To be sure the platform provides the stocks, ETFs, or other assets you wish to trade, consider your investment preferences and aims.

- Customer Support: Having dependable customer support is super important, especially when you run into technical hiccups or need a hand with your account. It’s a good idea to check if the trading website offers easy ways to get in touch with their helpful customer care team. Look for options like phone, email, and live chat – and make sure the folks on the other end know their stuff and are eager to assist you!

- Mobile Trading Experience: Consider mobile trading apps’ availability and features if you want to trade while on the go. See whether the platform has mobile applications compatible with your device’s operating system.

- Educational Resources and Community: Certain trading websites provide educational materials like tutorials, webinars, or community forums to support traders in boosting their knowledge and skills. These helpful resources can be really valuable, whether you’re just starting out or you’re a seasoned trader looking to keep on learning and staying engaged.

- Additional Features and Integration: Explore any additional features offered by the trading website, such as advanced order types, customization options, portfolio tracking, or integration with other financial services or tools. These extras can enhance your trading experience and streamline your overall investment management.

Reviews of Top Stock Trading Websites

eToro

Popular social trading platform eToro is renowned for its user-friendly design and social trading capabilities. It is appropriate for novices since it enables users to see and mimic the transactions of experienced traders. Stocks, cryptocurrency, and ETFs are just a few of the diverse assets available on the site. However, in comparison to other platforms, its costs and commissions could be greater.

TD Ameritrade

TD Ameritrade is a well-established and reputable platform with a comprehensive suite of trading tools and research resources. It is appropriate for both novice and seasoned traders since it provides a strong trading platform with cutting-edge features like thinkorswim. However, especially for regular trades, its commission prices might be significantly higher.

Interactive Brokers

Due to its cheap cost structure and wide selection of tradeable assets, Interactive Brokers is a platform that active and professional traders choose. It provides a robust trading platform with cutting-edge tools and flexible options. Beginners could find the site daunting, and it needs a minimum account balance to use.

Fidelity Investments

A reputable brand in the financial sector, Fidelity provides a user-friendly platform with a variety of investing alternatives, such as stocks, mutual funds, and ETFs. Both novice and seasoned investors can benefit from access to a wealth of research and instructional tools it offers. However, compared to other platforms, its commission prices for stock trading could be slightly higher.

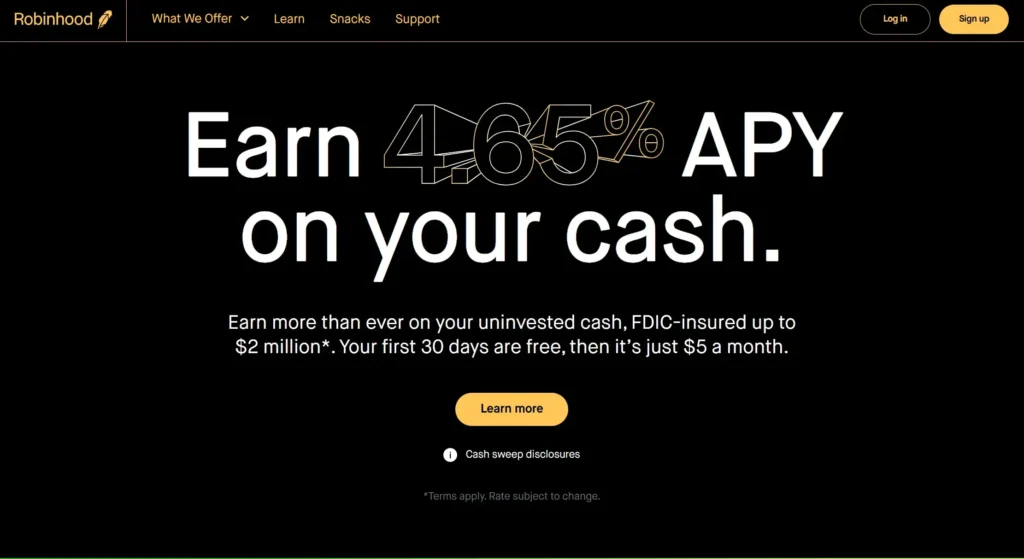

Robinhood

Robinhood became well-known for its commission-free trades and nimble smartphone app. It appeals to beginners and casual investors looking for a simple and accessible platform. On the other hand, it has a limited range of investment options and lacks advanced trading features and research tools compared to other platforms. It has also faced some controversies related to order execution and customer support.

Tips for Successful Online Stock Trading

- Set Goals: Establish your investing goals and a detailed trading strategy. Establish reasonable profit goals and risk tolerance limits to help you make decisions.

- Educate Yourself: Spend some time learning about stock trading’s foundational concepts, such as market dynamics, investing methods, and risk management. Continue to learn new things by taking classes, networking, and using reliable web resources.

- Launch Your Demo Account: Trade with a virtual or demo account before committing real money. You may do this to practice techniques, get more comfortable with the platform, and build confidence without running the risk of losing money.

- Conduct Extensive Study: Before making any transactions, conduct extensive study on the businesses or assets that interest you. To make wise investment selections, examine financial accounts, market trends, news, and other pertinent information.

- Make Your Portfolio more Diverse: By doing so, you may prevent placing all of your financial eggs in one basket. In order to reduce risk and increase possible returns, diversify your assets across a variety of markets, industries, and asset classes.

- Include stop-loss orders in your strategy to safeguard yourself against major losses. These orders work by automatically selling a stock once it hits a pre-set price, which helps minimize potential downsides.

- Manage Risk: Decide on management tactics such as position size, risk cap setting, and trailing stops. Be disciplined in following these strategies to protect your capital.

- Regularly Review and Adapt: Analyze your trading results, draw lessons from your errors, and adjust your strategy as necessary. Review your portfolio and adjust as needed to align with your goals.

Conclusion: Investing in Your Financial Future

Online trading platforms have completely changed how people engage in the quickly evolving world of stock market trading. Technology developments have driven the growth of online trading by enabling quick access to real-time data and helping investors make educated judgments. A wider spectrum of investors now have more opportunities because of lower transaction costs, while mobile trading applications provide flexibility and convenience. Consider the following factors when selecting a stock trading website: repute, user-friendliness, trading tools, order execution speed, fees, tradable assets, customer service, mobile trading experience, educational materials, and extra features.

To succeed in online stock trading, educate yourself, establish clear goals, start slowly with a demo account, do extensive research, diversify your portfolio, stay informed, use stop-loss orders, manage risk, control emotions, regularly review and adapt your strategies, and, if necessary, seek professional advice. Get ready to dive into the world of the best trading information websites as we embark on an exploration of the best platforms available!