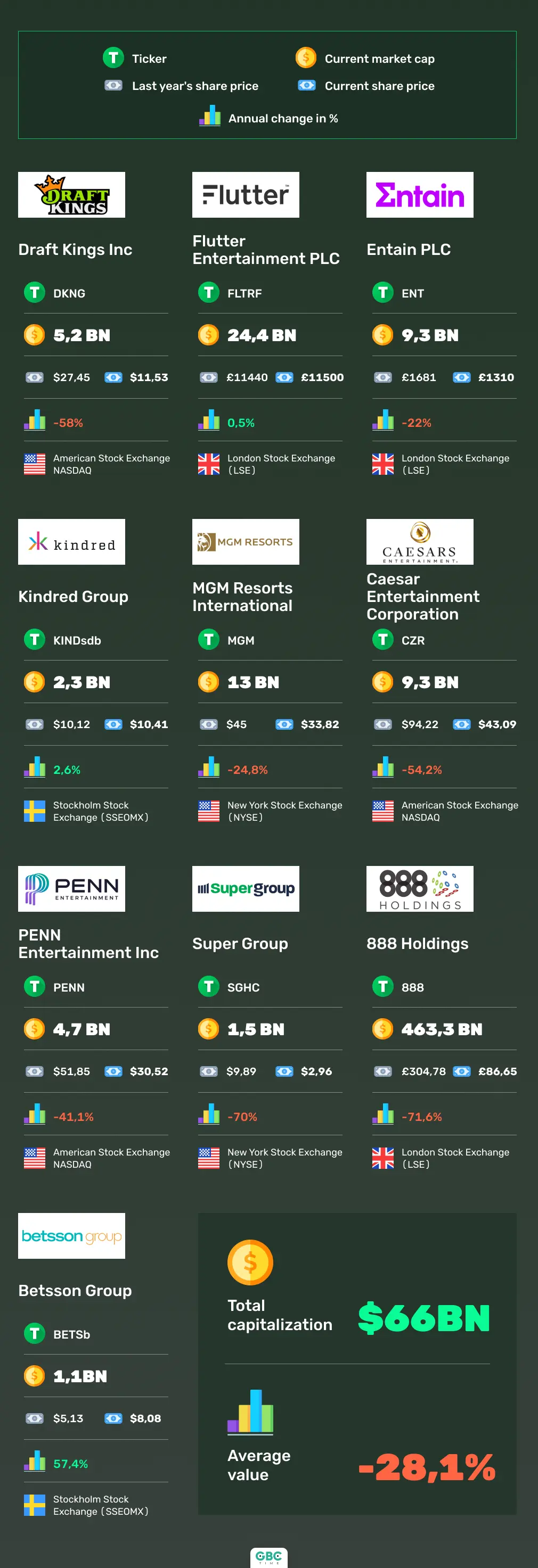

The gambling stock market is one of the largest and most profitable markets there is. Currently, around thirty major iGaming companies trade their stocks in different exchange markets. And in 2023, the total market capitalization for the top 10 of these companies reached $66 billion.

Last year, however, the value of the biggest gambling companies in the stock market dropped drastically. The Bookmaker Ratings website reports that the average change was about 28.1%. So, in this article, we will be taking a look at this phenomenon and trying to figure out what is going on.

Top 10 iGaming companies in the stock market

In 2022, the major iGaming companies were trading their shares in the following stock exchanges:

- American Stock Exchange (NASDAQ);

- London Stock Exchange (LSE);

- Stockholm Stock Exchange (SSEOMX);

- New York Stock Exchange (NYSE).

The following companies have become the top performers in the stock exchange market:

- 888 Holdings (888), which has a $463.3bn market cap. This Gibraltar-based company is the parent company for the major sports betting and iGaming brands like William Hill, 888casino, 888poker, and MrGreen ;

- Flutter Entertainment PLC (FLTRF) with a $24.4bn market cap. This Irish gambling holding was created by the merger of two large sportsbook groups – Paddy Power and Betfair. Later, the holding acquired the Stars Group;

- MGM Resorts International (MGM) with a $13bn market cap. Originating in America, MGM is a global entertainment company, which operates casino resorts all over the world. Currently, MGM has 29 hotel and destination gaming locations in the US and Macau.;

- Entain PLC (ENT) with a $9.3bn market cap. It is one of the biggest sports betting holding in the whole world that encompasses dozens of brands like Ladbrokes, Coral, PartyPoker, and more;

- Caesars Entertainment Corporation (CZR) with a $9.3bn market cap. Founded in 1937 in the US state of Nevada, Caesars is now one of the largest casino brands in America and the whole world;

- Draft Kings (DKNG) with $5.2bn current market capitalization. This an American sports betting and daily fantasy sports betting. The company provides its services globally in the US and Europe;

- PENN Entertainment Inc (PENN) with a $4.7bn market cap. This global iGaming brand owns 43 different gaming destinations from casinos to race tracks and online casinos and sportsbooks.;

- Kindred Group (KINDsdb) with a $.23 billion market cap. This Maltese-registered brand is one of the largest gaming holdings in Europe. It consists of nine brands, including Unibet, 32Red, and Maria Casino;

- Super Group (SGHC) with $.15vn market cap. One of the newest companies on this list, Super Group was founded just in 2020. The gaming holding unites two major iGaming brands – Betway and Spin;

- Betsson Group (BETSb) with a $1.1 billion market capitalization. This Swedish company specializes in online gambling and covers 20 brands like Betsafe, NordicBet, and BetSafe.

iGaming stock market changes throughout 2022

2022 certainly wasn’t an easy year for anyone. The upcoming economic recession has affected the online gambling market as well as many other industries. Throughout the past year just three of the said companies have experienced a rise in stock price:

- Betsson, where the price for a company’s share rose from SEK53.68 to SEK84.5. One of the reasons for the 57.4% growth may be the company’s entering the Mexican market.

- Kindred Group. Over the past year, the Swedish company’s share price increased by 6%, rising to SEK109.5 per share. This, however, is a result of Kindred entering the Dutch gambling market. As reported by Yogonet, on September 14, the company’s flagship brand Unibet launched its operations in the market of the Netherlands. Unibet has also signed a few partnership agreements with Dutch football clubs. At the same time, Kindred was forced to end its betting operations in Germany starting on July 1, 202 This definitely held back the company’s growth in the past 12 months.

- Flutter Entertainment. In 2022, This iGaming company showed the smallest growth – just 0.5%, from £11 440 to £11 500. At the same time, in Q3, Flutter’s revenue was £1.89bn – a 31.2% increase from the 2021 level.

All the other companies have experienced a drop in their stock market value throughout the past year. Namely, SuperGroup lost 70% of its share price, which dropped from $9.89 to $2.96. In 2022, 888 Holding acquired the UK sportsbook William Hill. In early 2022, the price for the deal fell from £2.2 billion to £1.95 billion. This is named as one of the reasons for the company losing 71.6% of its market share value, which fell from £304.78 to £86.65. The American daily fantasy sports betting company – DraftKings – has also experienced a shattering loss in its stock market value, which decreased by 58% compared to 2021. In 2022, the company’s financial results were poor. Besides, in December 2022, 67k player accounts on the DraftKings sites were hacked.

Conclusion

As seen from the results of 2022, iGaming brands are highly valued on the stock market. Considering that the overall capitalization reached $66 billion, the gambling brands have a space and perspective for growth in 2023. At the same time, many companies showed a decrease in the share price, with an average value dropping by 28.1%.