In the first weeks of 2023, gambling businesses and regulators tend to draw conclusions and sum up their activity in the past year, before setting goals and writing plans for the next years. And the European Betting and Gambling Association (EGBA) is not an exception. In its latest report, EGBA presents key figures for the European gambling market in the past year. The Association collaborated with the research center H2 Gambling Capital and conducted thorough research of the market.

So, in this GBC Time article, we will take an in-depth look at the main tendencies and trends in the European gambling market and make assumptions about what is going to happen in 2024.

Reopening of land-based casinos drives the market growth

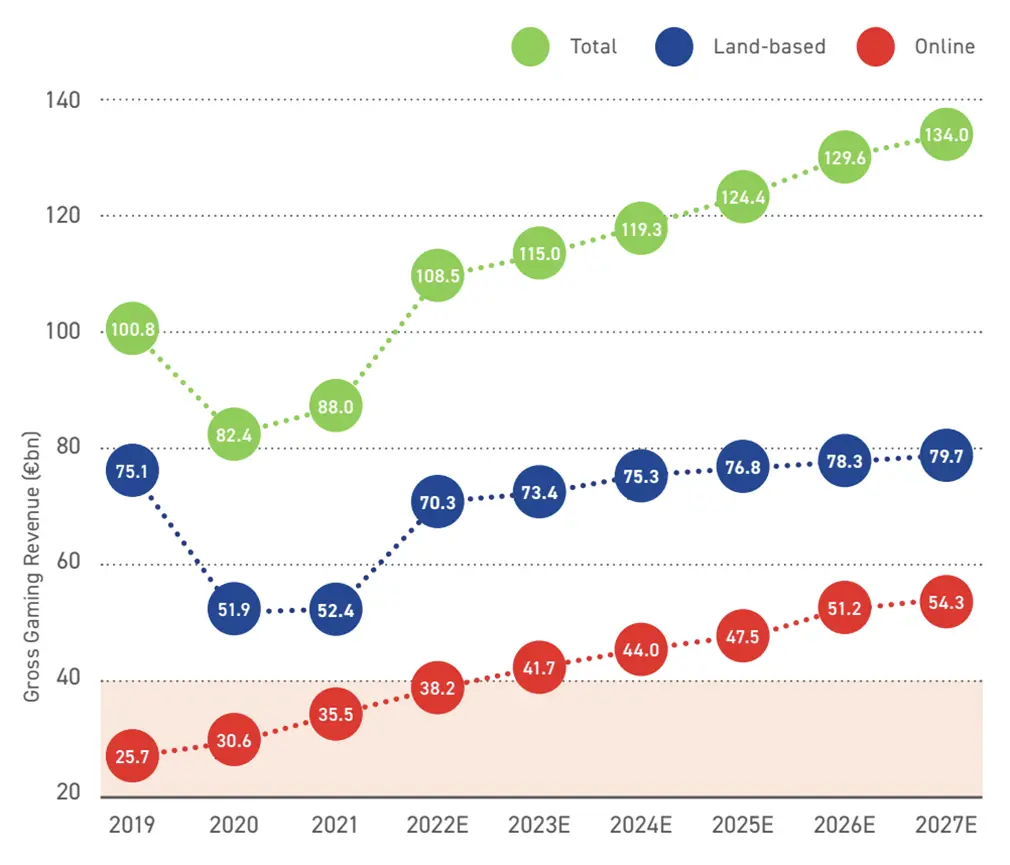

Given the current circumstance, like the end of lockdowns in Europe, it is no surprise to anyone that the gambling market is flourishing. In 2022, the industry generated €108.5 billion in gross gaming profits (GGR), surpassing even pre-pandemic levels by 8%. As for the previous 2021 year, GGR has grown by 23%, indicating the success of the gambling niche.

Unlike the previous two years, the land-based gambling scene was the main driver for the market growth. With the end of strict Covid rules, terrestrial venues started reopening, creating €70.3 billion in revenue in total. This is 65% of all gambling profits in Europe and is 34% more than in the last year.

Meanwhile, the online gambling market also continues to increase, generating 35% of all Europe’s GGR – €38.2 billion. This is a small but steady 8% increase since last year.

Nonetheless, EGBA predicts that in the future, the share of online gambling will grow, reaching 40% of the total European GGR and €54.3 billion in 2027.

Casino games become the most popular gambling product online

The EGBA study also shows the demand for different games of chance in Europe. According to the research, in 2022, Europeans preferred playing casino games. Casino games created €14.9 billion This category even outperformed the 2021 favorite – betting – by 4%. Traditionally, betting on sports is the main driver of profits, bringing €11.6 billion out of €13.6 billion in revenue.

As seen from the table above, the growth of the casino sector is going to continue over the next 5 years. Overall, the share of gambling products in the overall GGR in 2022 looked like this:

- 39% – casino games;

- 35% – betting (sports and horse racing);

- 18% – lottery;

- 4% – poker;

- 3% – bingo;

- 1% – other and skill games.

Mobile gaming continues to grow

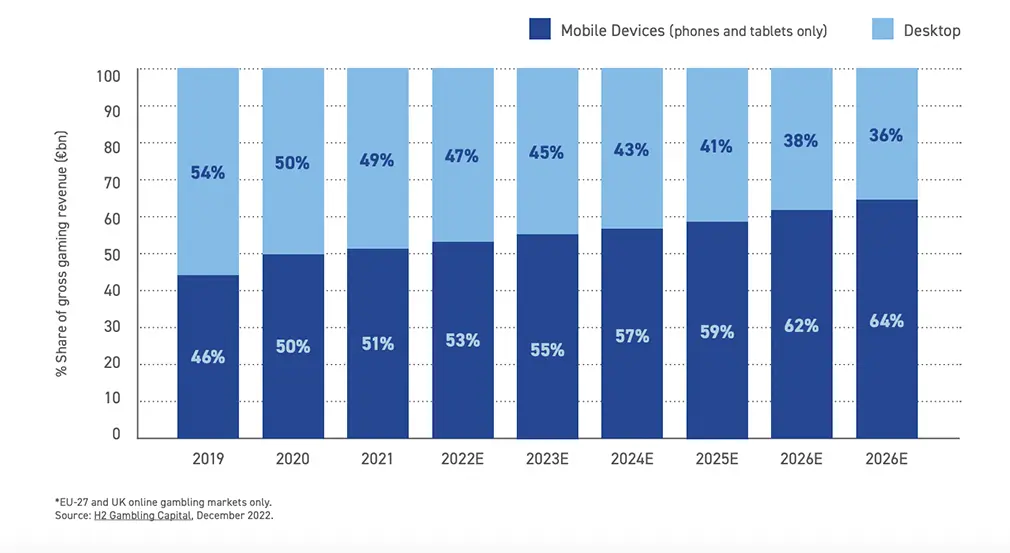

The other prominent trend highlighted by EGBA is the rise of mobile gambling. In 2022, 53% of all online players preferred to visit online casinos and sportsbooks from mobile and tablet devices. Seeing as this trend is only going to intensify, many iGaming operators and software providers invest in mobile applications or mobile versions of their games. And it seems that in 2023, this trend is only going intensify as EGBA predicts that 55% of all online gambling operations will be performed from the mobile.

Italy, the UK, and Germany become top gambling countries

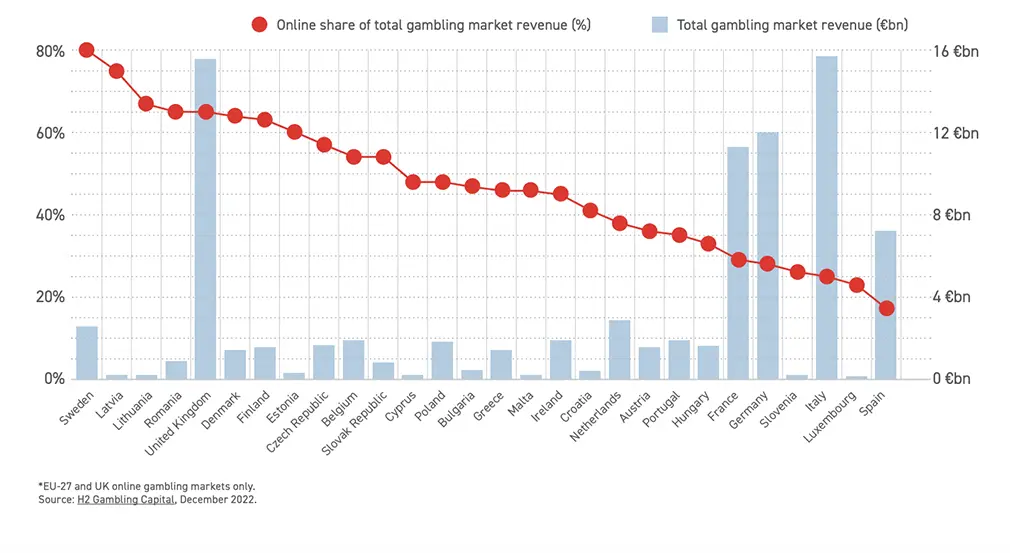

In 2022, the shares in the total gambling revenue of Europe changed drastically. Sweden was the top EU country for online gambling activity (80%), and the tight regulation in the country left their effect. Some other leaders were Latvia (75%), Lithuania (67%), and Romania (65%). At the same time, these weren’t the most profitable countries overall. Italy, the UK, Germany, France, and Spain generated the most GGR in both online and offline sectors.

The most common games of chance also vary from country to country. For instance, over 60% of Romania’s GGR comes from sports betting, while the Baltic countries (Latvia, Lithuania, Estonia) generate most of their gambling profits from casino games. The research also includes an offshore activity. Cyprus, where online casinos and poker games are banned, gets% of its gambling revenues from these games. France also derives 13% of its GGR from remote casino games, which are prohibited there.

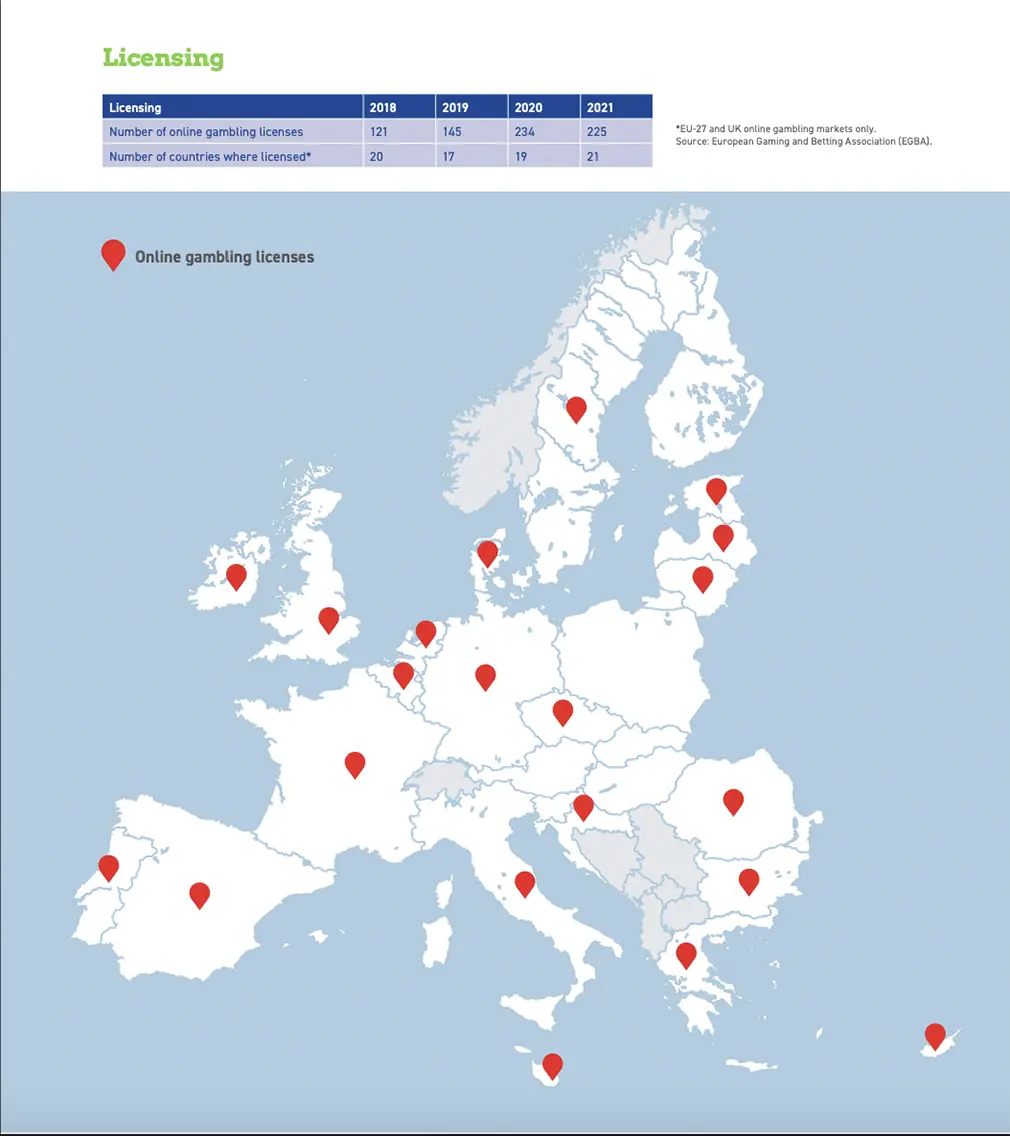

The number of iGaming licenses slightly drops

The legalization of gambling activities is going to be a huge trend for 2023 for sure. At the same time, in Europe, the number of online gambling permits drops compared to the 2020 level – from 234 to 225. This is, however, an obvious decline after the boom of online gambling, induced by the global pandemic.

Conclusion

The gambling market of Europe continues to grow and stay an attractive niche for many operators, software providers, and other iGaming brands. Here are some key takeaways from the EGBA research that may help gambling companies wanting to operate in these markets:

- While the online gambling market continues to grow, brands should not underestimate land-based gambling venues as they bring in the most GGR in Europe;

- As for gambling products, the top picks of Europeans are online casino games and sports betting;

- The role of mobile gambling consistently grows and many iGaming brands invest in mobile apps or at least mobile versions of their website. Accessibility and good UX of a game have never been more important;

- Scandinavian and Baltic countries are best known for online gambling. Meanwhile, more traditional states like the UK, Italy, Spain, and France have higher overall GGR;

- While the trend for licensing is slightly declining, it is important to comply with all regulations in the UK and EU.