In recent years, the financial market has undergone a remarkable revolution propelled by groundbreaking technological advancements. The fusion of machine learning and artificial intelligence (AI) has reshaped the landscape of investment management, offering investors unprecedented efficiency and accessibility. However, this transformation would not be complete without acknowledging the catalytic force that has revolutionized countless industries across the globe – the Internet.

The Internet stands as one of the most disruptive and transformative technologies in human history, instigating a profound paradigm shift in the way people consume, transact, and communicate. The environment of investing has become more open because of the introduction of Internet platforms, data-driven research tools, and real-time market information. Today, the Internet has made it possible for anyone with an Internet connection and modest capital to engage in the financial markets, leveraging the same powerful tools and information that were once accessible only to a privileged few.

In this article, we will explore the profound impact of the Internet on the investment world and delve into the ways it has revolutionized traditional approaches. We will also examine the key factors of technology transformation, including big data analytics, the integration of AI, and machine learning, and their implications for investors. Moreover, we will shed light on the challenges and opportunities presented by the digital landscape and provide insights into how you can navigate this new era of empowered investing.

A Brief History of Using Technology in Investing

The application of technology in investing has a rich history, with each era witnessing significant developments that have fundamentally transformed the process of making investment decisions.

In the 1970s, the introduction of computer-based trading systems marked a pivotal moment in the use of technology in investing. These systems allowed traders to automate order execution, leading to faster and more efficient transactions. As technology continued to evolve, the 1980s saw the rise of online trading platforms, enabling investors to place trades electronically from the comfort of their homes or offices.

The 1990s brought forth the era of online brokerage firms, which provided retail investors with direct access to the financial markets. This shift eliminated the need for traditional intermediaries, such as brokers, and democratized investment opportunities. The widespread adoption of personal computers and the internet during this time played a crucial role in expanding access to financial information and research tools.

The turn of the millennium witnessed further advancements in technology, particularly with the proliferation of mobile devices. The introduction of smartphones and tablets allowed investors to monitor their portfolios, receive real-time market updates, and execute trades on the go. This mobility and instant connectivity transformed the way investors interacted with the markets, making investing more accessible and convenient than ever before.

What now?

Today we see big development of technologies, which have proliferated in the banking sector. This advancement has inaugurated a fresh epoch of investment guided by data, wherein algorithms can analyze extensive data sets, recognizing patterns to drive well-informed choices in investments. Intelligent robot advisors have emerged, providing automated portfolio management services to retail investors at a fraction of the cost charged by traditional financial advisors.

The strides taken in cloud computing and storage have also facilitated the processing and retention of vast quantities of financial data. This empowerment has given investors the capacity to utilize advanced analytics tools for thorough research and in-depth risk analysis. Fintech startups have disrupted the industry, offering innovative solutions such as crowdfunding, peer-to-peer lending platforms, and digital payment systems, further reshaping the investment landscape.

Looking ahead, blockchain and cryptocurrencies hold the potential to revolutionize investing even further. Blockchain technology offers transparent and secure transactions, while cryptocurrencies provide new avenues for investment and fundraising.

The Impact of the Internet

The advent of the Internet has revolutionized investing by granting unparalleled access to a wealth of information. Before the Internet era, retail investors relied on local libraries to peruse financial literature and gather research on companies and securities like bonds, stocks, and mutual funds.

Alternatively, investors could contact companies directly to obtain the latest financial reports, but this approach came with drawbacks. It incurred costs for postage and required patience, as investors had to wait for the reports to be printed and sent by the company’s investor relations department.

The Internet changed the game entirely. Now, investors can swiftly access online company reports from the Securities and Exchange Commission (SEC) website as soon as they are posted. Large financial papers may be quickly downloaded, and they are simple to search for using key phrases, subjects, or particular financial statements. Companies create internet portals for investors where they may access these filings, annual reports, and speeches made at industry conferences.

Moreover, a multitude of websites compile and provide financial information for analysis and comprehension. Many websites offer financial information for free, while others charge nominal annual fees for more specialized data, ensuring equal opportunity for individual investors.

In summary, the Internet has significantly increased individual empowerment, which has had a revolutionary effect on how investors acquire financial information. It has brought a notable decrease in prices for the vast majority of financial market participants.

Technology Benefits for Investing

Enhanced Efficiency

Trading platforms, automated systems, and algorithmic trading have streamlined processes, enabling rapid execution of trades, instant access to market data, and real-time portfolio monitoring. This allows investors to capitalize on market opportunities promptly and make decisions with agility.

Democratization of Investing

Technological advancements have obliterated entry barriers, democratizing the realm of investing in unprecedented ways. Online brokerage firms and investment apps have opened doors for retail investors, allowing them to participate actively in the financial markets. The elimination of hefty fees, minimum investment requirements, and geographical limitations has enabled a broader range of individuals to engage in wealth creation and financial growth.

Automation and Risk Management

Technological tools have enabled automation. Robo-advisors use algorithms to construct and rebalance portfolios based on investors’ goals and risk tolerance, eliminating human biases. Additionally, risk assessment models make use of machine learning and big data analytics to offer insights into possible hazards, allowing investors to make better decisions and reduce negative exposure.

Portfolio Diversification

Access to a wide range of asset classes, such as equities, bonds, mutual funds, exchange-traded funds (ETFs), commodities, and even nontraditional assets like cryptocurrency, is possible in the digital world. Technology makes it simple to diversify assets across different markets and sectors, which lowers risk.

Global Market Access

The Internet has bridged geographical boundaries, granting investors access to global markets. Through online platforms, investors can trade international securities, participate in initial public offerings (IPOs) across the globe, and explore investment opportunities in emerging markets. This global connectivity broadens the horizons for investors, presenting opportunities for possible expansion and diversification.

Cost-Effectiveness

The digitization of investing has introduced cost-effectiveness to the forefront. Online trading platforms often provide lower commission fees compared to traditional brokers, reducing transaction costs. Moreover, the rise of inexpensive index funds and ETFs has allowed investors to access diversified portfolios at a fraction of the cost charged by actively managed funds.

Negative Consequences of Technologies in Investing

Although technology has greatly benefited the world of investing, it is crucial to understand that there may also be unfavorable effects from its use. Let us explore some of these drawbacks:

Increased Market Volatility

The emergence of algorithmic trading and high-frequency trading has increased market volatility. Rapid-fire trades executed by machines can exacerbate market swings and lead to sudden price fluctuations. This heightened volatility may create challenges for long-term investors and increase the risk of market instability.

Overreliance on Automation

As automation becomes more prevalent, there is a risk of overreliance on technology without proper human intervention. Using only algorithms and robo-advisors may neglect the importance of human judgment and intuition. It is crucial to strike a balance between utilizing technology and maintaining a human touch to ensure sound investment decision-making.

Cybersecurity Risks

The danger of cyber-attacks and data breaches has grown with a growing dependence on digital platforms. Constantly looking for weaknesses in financial systems, hackers and cybercriminals run the risk of exposing private investor data and undermining market integrity. Strong security measures and continual awareness are needed to protect against cyber attacks.

Loss of Personalized Advice

While robo-advisors and online investment platforms offer convenience and cost-effectiveness, they may lack the personalized guidance and tailored advice provided by human financial advisors. Technology-driven investment solutions might not adequately address individual circumstances, goals, or risk profiles, leading to potential misalignment with investors’ needs.

Data Reliance and Bias

Technological advancements heavily rely on vast amounts of data. However, biases or inaccuracies in the data used for analysis can result in flawed investment decisions. Additionally, the algorithms themselves may inherit biases from the data sets they are trained on, potentially perpetuating inequalities or overlooking certain market dynamics.

Technology-Driven Bubbles

The fast dissemination of information and the speed at which market trends develop can contribute to the formation of speculative bubbles. Online forums and social media can amplify investor sentiments, leading to herd behavior and irrational exuberance. Such market euphoria, fueled by technology, can inflate asset prices beyond their fundamental values, potentially resulting in market crashes or significant corrections.

The Future of Bonding Technology and Investing

The future will witness an astonishing transformation of the financial markets, rendering them unrecognizable compared to their current state. At the core of this metamorphosis lies technology, serving as the driving force behind the revolutionary changes that lie ahead.

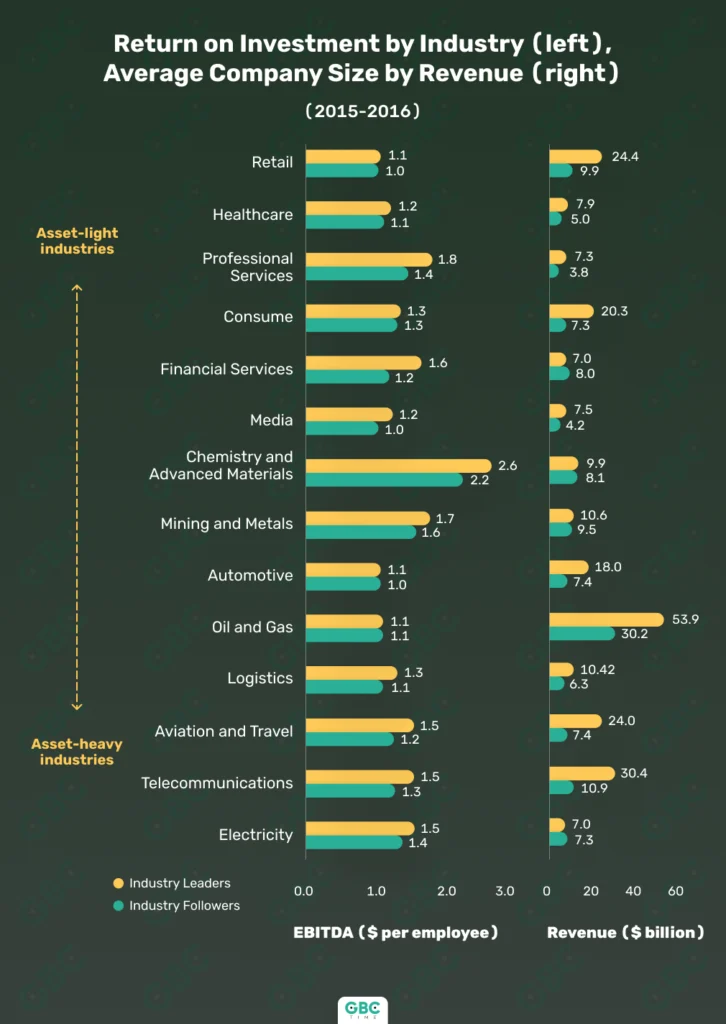

According to the World Economic Forum, some industries benefit more from technology investment than others. As we see, Financial Services are in the top 5 on the list.

The development of artificial intelligence and machine learning is one of the most important factors influencing the future of investment. As a result of these technologies’ ability to handle information more quickly and precisely than people, risk management and investing methods have improved.

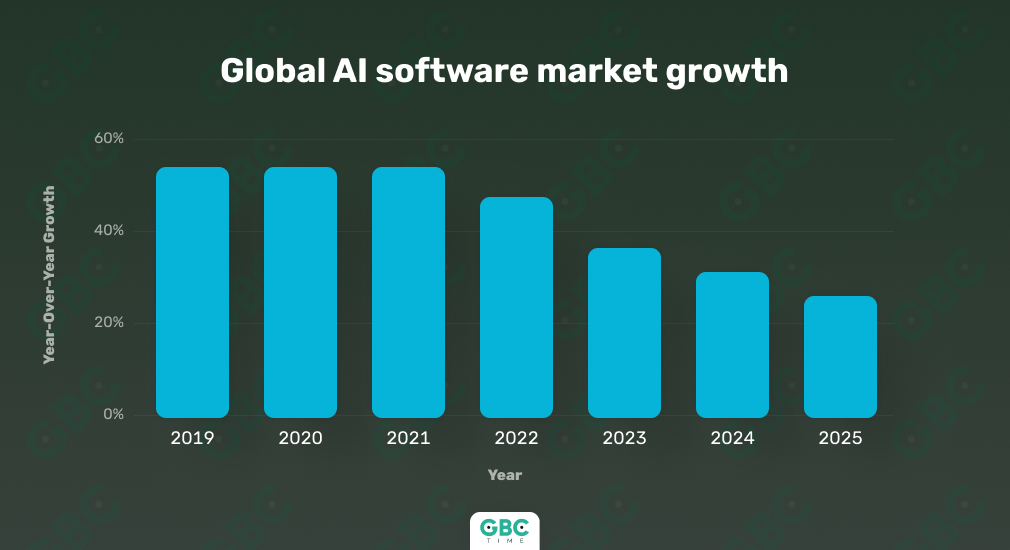

According to the most recent research, the AI sector will be prosperous shortly. It was predicted that through 2025, this rising trend will increase by at least 26% per year.

Additionally, robo-advisors and automation are becoming more popular in the investment sector. Digital platforms use algorithms to manage portfolios and offer individualized investing advice. These platforms are more affordable for investors since they charge lesser costs than conventional financial advisors. By automating routine tasks and using algorithms, robo-advisors may maximize asset allocation, rebalancing, and tax efficiency. As a consequence, investors receive higher returns.

Another technology with significant potential in investing is blockchain. Blockchain, a decentralized and transparent ledger system, can revolutionize the way transactions are conducted and recorded. Smart contracts, powered by blockchain, can automate and enforce investment agreements, eliminating the need for intermediaries and increasing efficiency.

Big data and predictive analytics are also becoming more and more important in the process of choosing investments. With the use of robust analytics tools and the accessibility of enormous volumes of organized and unstructured data, investors may more accurately spot patterns, identify market trends, and predict future performance. This data-driven strategy may result in better risk management procedures and more intelligent investing methods.

Future developments in quantum computing should also have an effect on the financial environment. Quantum computing’s unparalleled processing power can potentially tackle complex calculations and optimize portfolio construction. It could revolutionize risk modeling, asset pricing, and portfolio optimization, leading to more sophisticated investment strategies and improved risk-adjusted returns.

However, as technology continues to shape the future of investing, it is crucial to address potential challenges and risks. In a technologically sophisticated investing environment, ethical issues, data privacy, and cybersecurity will become more and more crucial. Regulatory frameworks will need to adapt to ensure investor protection and maintain market integrity.

Conclusion

In conclusion, the integration of technology into investing has ushered in a new era of empowerment and accessibility for individual investors. The Internet, in particular, has revolutionized the investment landscape by providing unparalleled access to information and leveling the playing field. Advancements in big data analytics, AI, machine learning, and blockchain have further enhanced efficiency, expanded investment opportunities, and improved risk management practices.

Contemporary investors possess the capability to utilize cutting-edge trading platforms, instantaneous market data, and research instruments that empower them to make well-informed choices. The democratization of investing has been achieved through automation and robo-advisors, which provide cost-effective portfolio management services to individual investors. This has led to newfound opportunities for wealth creation, facilitated by simplified diversification, enhanced global market reach, and lowered expenses.

However, it is important to acknowledge the potential challenges that come with technology in investing. Market volatility, overreliance on automation, cybersecurity risks, and the loss of personalized advice are among the factors that investors must navigate. Data reliance and biases also pose potential pitfalls that need to be addressed to ensure sound investment decisions.

As technology continues to evolve, it will reshape the environment of investing even further. The future promises more innovatory algorithms, quantum computing, and technologies like blockchain and cryptocurrencies, which can further transform the way investments are made and managed.

Here investors need to stay informed, adapt to new technologies, and maintain a balanced approach that combines the benefits of technology with human judgment. By embracing the opportunities and mitigating the risks, investors can navigate this digital era of empowered investing and strive for long-term financial success.