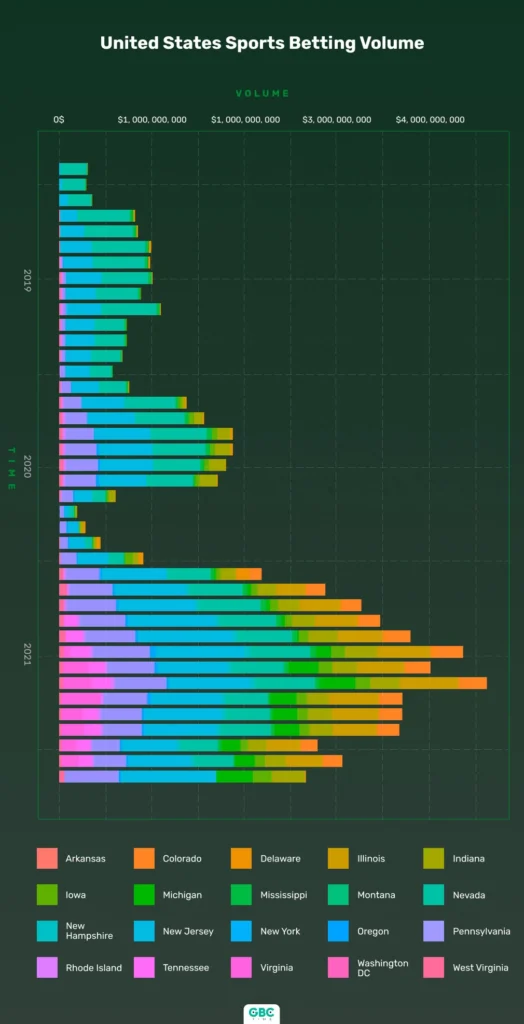

Being a rapidly growing industry, sports betting provides many investment opportunities for those who are interested in increasing their capital. Contrary to popular belief, this business does not revolve around sportsbooks exclusively and covers other interesting niches. In this comprehensive overview, we will analyze the major sports betting industries from an investment perspective. And you will get a better idea of which stocks and funds you should focus on the most.

What is investing in sports betting?

When it comes to sports betting investments, you can spread your funds across several key industries. Companies that operate sportsbook sites and apps are a fairly popular option. However, you should bear in mind that the following investment areas are also profitable:

- gaming companies;

- tech providers;

- exchange-traded funds;

- racetracks.

Each of these sports betting niches has established and promising players who have shown steady growth over the past years. So, if you want to invest your money in this business, you need to understand which of these companies or funds will give you the best chance of returning your investment with a reasonable profit.

Advantages and disadvantages of sports betting investments

| Pros | Cons |

| The market shows positive trends in recent years | High activity among investors drives up share prices |

| Investors have several key areas to invest in | Many countries subject the sports betting industry to heavy taxation |

| Sports betting is becoming more popular thanks to online sportsbooks and mobile apps. | Legislative regulations regarding sports betting are updated dynamically |

| Investors can buy shares from time-proven established companies |

Gaming exchange-traded funds

Many novice investors ignore this market, even though it is one of the most trending in the last 20 years. Essentially, exchange-traded funds (ETFs) offer you a different format for buying and owning stocks. Instead of buying specific shares, such funds allow you to buy a fraction of every stock they own. In other words, if the ETF you are interested in has 200 shares, you will be able to purchase a tiny fraction of each of those shares.

Roundhill Sports Betting and iGaming ETF

This fund specializes in several types of investments, including sports betting, esports, Metaverse, and digital infrastructure. Launched in June 2020, Roundhill, which uses BETZ as a ticker, has already managed to cover 43 holdings. With an expense ratio of 0.75%, you will be able to get excellent exposure in the US sports betting market, which is expected to grow immensely by 2025 according to Bruin Sports Analytics.

Take a look at some top holdings and documents the Roundhill fund offers to its investors.

VanEck Video Gaming and eSports UCITS ETF

This fund is also one of the most promising in 2022. And it focuses not only on video gaming and esports companies but also on sports betting brands. VanEck was launched in 2019 with the ESPO ticker. Through this fund, you will have access to 25 holdings, and your total expense ratio will be 0.55%.

Racetracks

Horse racing is an incredibly graceful sport that attracts millions of bettors around the globe. Anyone who wants to be part of this business should take a closer look at the iconic Churchill Down company. Most gambling enthusiasts know it because of the annual Kentucky Derby, which generates record amounts of bets. However, this company that uses the CHDN ticker also operates the sports betting site TwinSpires. The platform specializes in both horse racing bets and all the most popular sports in the world.

Reputable gaming companies

Companies that are considered the most significant players in the casino market operate not only the world’s best land-based establishments but also sportsbooks. Moreover, they can specialize in both offline betting and online betting platforms suitable for fans of any sport. When you invest in such stocks, you need to understand that your ROI (return on investment) will not depend solely on betting. Beyond that, it will be dictated by various resort and gambling operations.

Penn National Gaming

While most bettors know this company with the PENN ticker through its gambling venues located across the USA, it has made serious strides in the online betting industry. In 2020, Penn National entered into a deal with Barstool Sports and acquired a 36% stake in this popular sports blog site. On top of that, it has acquired Score Media, a company that spans the mobile market through theScore app.

Las Vegas Sands

Unlike the previous option, this company with the LSV ticker focuses on gambling entertainment to a much greater extent. However, you should keep in mind that Las Vegas Sands owns the most profitable casinos worldwide, and it has already started to expand into the betting market. So, if you make a timely investment in this gambling giant, you have an excellent chance of making a tremendous profit within a few years.

Software providers

Keep in mind that you can invest your money in both gaming companies and software providers, which are responsible for the technological basis of any sports betting or gambling platform. Given the rapid development of the industry as a whole, these studios are also experiencing remarkable growth. And some of these companies may already be profitable for you.

Kambi Group

Founded in 2010, this company uses the KMBIF ticker when it comes to stocks. It specializes in the development and support of software platforms that run betting or gaming operations. Kambi’s B2C products already have numerous fans in the gambling industry. Therefore, this investment direction can be quite promising for you.

GameAccount Network

Since this provider started operating back in 1999, it has gained a veteran status in the market. You can find the GameAccount Network stock under the GAM ticker. It offers gambling and betting operators a myriad of software solutions, including sportsbook integration, marketing tools, and more. This company is surely confident in its market position, as it always shows the stock’s rate in a real time on the official website.

Sportsbook apps

This investment direction is the most extensive. However, you should bear in mind that the sports betting market is growing very dynamically, and certain mobile applications give you more chances to return your investments with a significant profit. Let’s take a look at some of the more popular sportsbooks that have millions of users.

Flutter Entertainment

When BetFair and Paddy Power bookmakers merged and took over The Stars Group, they founded Flutter Entertainment in 2016. You can find shares of this Ireland-based betting holding company under the PDYPY ticker. It owns numerous sub-brands which allow them to cover more than 40% of the American online betting market. These include Sky Betting and Gaming, FanDuel, and Betfair.

Caesars Entertainment

Considering that this company owns many of the top-performing casinos in the United States, it is not surprising that its sportsbook app is also extremely popular among bettors. After unsuccessful advertising decisions that Caesars has made over the past three years, it wants to use more targeted marketing initiatives without a national reach. Financial experts expect that this approach will allow the company to improve its position in the market significantly. Therefore, you definitely should check out its CZR stock from time to time.

Rush Street Interactive

Those interested in less expensive stocks should take a look at Rush Street Interactive. Compared to previous giants, this Chicago-based company is less established. But at the same time, it is actively growing in the sports betting market by offering players both land-based and online sportsbook options.

In this article you can read about best affiliate betting programs.

What risks do sports betting investors face?

Since this is a rapidly growing industry that generates huge amounts of money, government agencies of different countries tend to capitalize on this market. Even if a particular betting company operates without any strict legal restrictions today, governments are actively examining this industry and may reform it radically in the coming years.

As a rule, the authorities dedicate gambling laws to several key factors:

- Taxation for both betting platforms and bettors’ winnings or transactions;

- Ban gambling sponsorships and advertising in general. The fewer potential customers see ads with betting sites and outlets, the less opportunities for growth remain for the companies in which you invest;

- Changing the legal gambling age in land-based and online segments;

- A quickly growing number of bettors with problem gambling habits;

- Fighting the unlicensed betting market to protect gamblers from suspicious or fraudulent operators.

When countries adopt such legal regulations, betting companies face new hurdles and often lose some market capitalization. That is exactly why you should invest in those companies operating in countries that are trying to grow the legal gambling market instead of slowing it down.

Bottom line

While the sports betting industry is a promising investment niche on its own, there were some external aspects that influenced its development recently. As web and mobile technologies have improved, numerous people have been able to learn more about betting and the industry in general. On top of that, many individuals joined the betting community during the most dangerous waves of the global pandemic, when they were forced to stay at home.

Another crucial benefit is that you can choose exchange-traded funds instead of investing your money in the shares of a specific betting company. This approach allows you to diversify your investments even if you do not have a substantial budget.

Read more: Betting Affiliate Programs