The European gambling market, including the UK, has faced many challenging problems and obstacles after the COVID-19 pandemic with its lockdown measures came to the game. At the very beginning of this happening, gambling operators and betting companies didn’t know how to handle this issue and make a profit. However, the beneficial solution was almost found immediately, and precisely this solution helped the European gambling market stay on a relatively good level of its revenue.

In this infographic, GBC Time has gathered financial reports from the European Gambling Regulator and different countries separately to present you in-depth statistics on how the European gambling market has recovered from the pandemic consequences in terms of revenue. Additionally, we’ve added the former member of the European Union – the United Kingdom – to the provided data.

This infographic aims to show you the great potential of the gambling business and its financial perspectives.

Make sure that you’ve subscribed to the GBC Time newsletter not to miss anything important from the world of gambling. So, let’s have a close look at how the European gambling market felt right after the beginning of the pandemic.

Infographic: European gambling market revenue in 2019

After the global pandemic came to the game in 2019, the European gambling market had no clue how to deal with it and how to overcome the difficulties caused by the coronavirus measures and restrictions. Many land-based casinos were forced to close their doors and stop operating. However, it was a perfect moment for the online segment of the gambling business to rise and shine.

For sure, most of the revenue came from the land-based gambling sector. And in 2019, the land-based segment brought 74.5 billion euros, while the online segment made a pure profit of 26.1 billion euros. The difference is significant.

In general, the gambling market revenue of the European market plus the UK reached an edge of 100.6 billion euros in the 2019 fiscal year.

So, at this point, you have the first annual gross gambling revenue result of the European market. And the next stage of this infographic is to show how the implemented measures and the gambling companies’ actions affected the results of the following year.

Infographic: European gambling market in 2020

Since almost all land-based gambling houses were closed “thanks” to the security measures, it should be evident that the revenue may go down. Yes, this assumption is the correct one.

As you can see on the graph below, the total gambling revenue showed not the best possible result. The profit was decreased to 81.1 billion euros, which is 19.4% lower compared to the previous year.

The revenue drop of the land-based sector caused a significant fall in the total gambling revenue. The European Gaming and Betting Association revealed that the revenue fell from 100.6 billion euros to 81.1 billion euros.

The land-based sector showed a crazy decrease of 32.1% compared to the previous year’s result, having just 50.6 billion euros of profit.

The online segment was a key to success because its revenue went up to 16.8%. The analytics have started to believe that the online gambling sector has a rather good potential for further perspectives and financial prosperity.

Infographic: European gambling market in 2021 (expected)

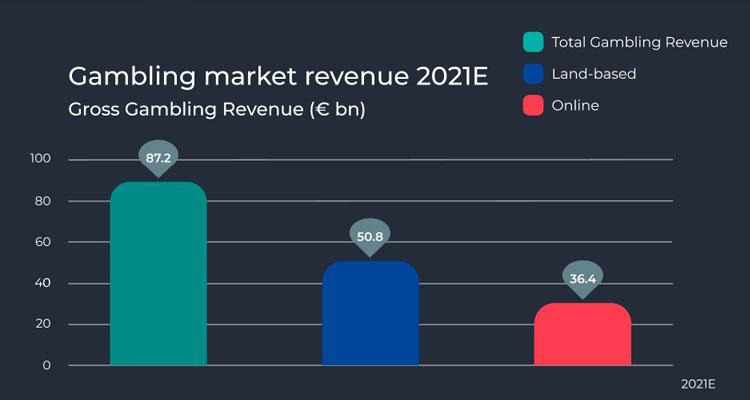

Up to date, there is no complete report of the gross revenue of the European gambling market in 2021. For this simple reason, the analytics conducted a report with the expected gross income for both land-based and online sectors.

If the previous infographic has shown a decrease in the total gambling revenue, the fiscal year of 2021 has a slightly better-anticipated result.

According to the European Gaming and Betting Association, the total gross revenue of this market will have a better time and a slight increase. The experts will expect the revenue’s growth from 81.1 billion euros to 87.2 billion euros. Still, the difference is 7.5%. Of course, this progress cannot be called significant, but there is hope for a bright financial future for the gambling business.

As you can see in the graphic below, the land-based sector is expected to bring a significant part of the annual income. But it is becoming more evident that the online sector of the iGaming industry tends to rise! Compared to the first year after the global pandemic, the online segment shifted from 26.1 billion euros to the expected sum of 36.4 billion euros in 2021. Putting this data in simple words, this sector has grown by 39.4%.

The black sheep remains the land-based part because of the substantial revenue decrease from 74.5 billion euros to 50.8 billion euros, which means a fall of 31.9% down. And it’s not wondering! The online gambling sector hasn’t had so many restrictions as the land-based one has been facing even these days. But thanks to the right actions of the gambling companies, the gambling business has tremendous financial potential even despite all these difficulties and challenging restrictions.

Most popular online gambling products in the European gambling market

According to the statistics provided by H2 Gambling Capital, the organization revealed a pie chart, which indicates the most popular online gambling products with the biggest % share of gross gaming revenue.

Without any doubt, the largest part of this chart takes Sports betting with 40% of shares. The next place goes to casinos with its part of 34%. Lottery, poker, bingo, and other skill games fill the rest of the chart’s space, having 17%, 5%, 3%, and 1%, respectively.

Following the mentioned-above statistics, the organization prepared a table highlighting gross gambling revenues by separated sectors.

Looking at this table, it is clear what exactly sub-categories of the online gambling business are more perspective in terms of income. Recently, sports betting, including horse racing, held a dominating position. But after the situation with the COVID-19 pandemic, casino, poker, bingo, and skill games are overrunning the betting and are becoming more and more valuable.

The most profitable European counties (+ the UK) by gross gambling revenue

Gambling is legalized in many European countries to some extent. Many gambling enthusiasts and admirers love spending their free time and money playing these or that casino games and placing their bets on different sports events. However, in some countries, gambling is top-rated entertainment, and there is a world-map infographic indicating the gambling markets (the European Union + the UK) with the largest gross gambling revenue. The data is for the fiscal year of 2020 because there is no detailed data for 2021.

Although the UK does not belong to the European Union, this country has the highest result of 15.99 billion euros, which is 19.7% of the total gambling revenue. The most gambling nation, which is a part of the European Union, is Italy, with its total gross income of 13.2 billion euros.

Germany has not gone far from these leaders and earned 12.1 billion euros during the 2020 fiscal year.

Gambling in France is a widespread phenomenon that allowed the country to get 10.2 billion euros of gambling revenue.

Spain has not the best result in this regard, but it earned 6 billion euros during 2020.

And the Netherland, a country where gambling became legal relatively recently, showed an excellent result of 2.99 billion euros of profit from this industry, outrunning other countries with more extensive gambling history.

The mentioned-above countries generated 74.2% from the total gambling revenue in the market.

Considering the less valuable players in the European gambling market, the lowest revenue rate comes from Luxemburg, Malta, Estonia, and Lithuania. These counties could not even reach the edge of 200 million euros.

Conclusion

The analytics of the European Gaming and Betting Association, together with the experts from H2 Gambling Capital, found out that many European countries and the UK overcame the pandemic problem and figured out this challenging issue. As a reward for their efforts and on-time-taken solutions, the gambling business has an insignificant money loss and a prospect for a bright future.

Moreover, the experts predict a progressive growth of the gambling business, specifically the rise of the online sector. They assume that the total gross gambling revenue will be doubled by the end of the 2026 fiscal year.

Read more: Top Gambling Affiliate Programs